Nicola Yeomans shares insights on the significance of the ASEAN-Australia Summit 2024 and investment opportunities for superannuation funds, on the sidelines of discussions with business leaders at the seminal event.

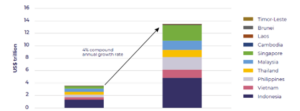

The ASEAN region is set to become the world’s fourth largest economy in the next 16 years, bringing significant development and investment opportunities. The potential is clear. Realising this potential is a priority for Australian and ASEAN governments.

Half a century of strategic partnerships and diplomatic ties has seen Southeast Asia reach number two on Australia’s list of trade partners. Yet investment and trade opportunities with Southeast Asia remain relatively untapped. For the Southeast Asia region, Australia ranks eighth as a two-way goods trading partner, with only 3.4% of trades – a proportion unmoved for two decades.

In March 2024, nine ASEAN leaders were welcomed by Australian Prime Minister Anthony Albanese to a celebratory ASEAN-Australia Special Summit. The fact that they were joined by hundreds of business representatives, government officials and others descending on the host city of Melbourne shows the strong interest in the region and its economy.

Why should we consider the region when investing? What are the challenges – and how can corporates make the most of the opportunities across the region? KWM co-head of private capital Nicola Yeomans was a member of the reference group to the landmark report led by Nicholas Moore AO, Invested: Australia’s Southeast Asia Economic Strategy to 2040 (Moore Report).

In this post, we give a quick snapshot of Nicola’s perspectives on the key to seizing those opportunities – particularly for superannuation funds.

Nicola spoke with the AICD’s Company Director magazine for its February 2024 issue. Read the fascinating article in full here.

- The Moore Report is significant – here’s why you need to read it (and understand the importance of the ASEAN region)

The report was published in September 2023 after almost a year of consultations, including conversations with more than 750 people and considering around 200 written submissions. Across 75 recommendations, the Moore Report called for increased awareness, fewer blockages (including tariff barriers), enhanced skills and capabilities and deepening investments. The green energy transition, digital economy and infrastructure were among key targets of the recommended efforts.

In his foreword, Mr Moore notes how the prosperity and security of Australia and its neighbours are “intimately linked” – and there’s a vital role for Australia to play. Boosting trade and investment, Moore noted, needs a long-term effort from business and government.

“We have the potential to be a substantial investor due to our well-capitalised corporate sector, our deep and sophisticated capital markets, and our substantial national savings pool, including our superannuation industry.” – Nicholas Moore AO, Foreword to the Moore Report

- Superannuation funds should consider investment opportunities in Southeast Asia

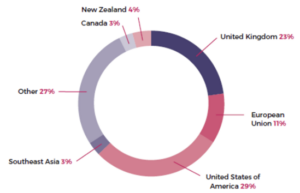

Canada, the United States and Europe are consistently favourable – and favoured – investment destinations for Australia’s superannuation funds. The Moore Report data is compelling: only 3.4% of Australia’s foreign investment stocks went to ASEAN countries – and three quarters of it went to just two of those nations (Singapore and Timor-Leste).

By comparison, Canada has increased levels of foreign direct investment – including by pension funds. The Moore Report notes they are ‘a few years ahead of some counterparts in developing trusted relationships’.

The Moore Report contains significant data – it’s a fascinating read. Here are just two of the compelling graphics that tell the story of untapped potential:

Share of Australia’s outward foreign investment stocks by destination 2022

Source: Moore Report

Nominal GDP of Southeast Asian economies 2022 (estimate) and 2040 (forecast)

Source: Moore Report

- Investors should concentrate on a target market to begin with

The fees for fund management – often required to manage inherent risks – can act as a turn-off for super funds. Among the key risks that gives rise to the need for management help is the possibility of a change in government, given the abundance and prominence of State-owned entities across Southeast Asia.

Targeting investments to concentrate on one market is a sensible way to enter and manage risks against returns, as is joining with other investors to spread the risks (albeit while also spreading the return).

- Deep due diligence and local partnerships are key

A local partner who is details-oriented and dedicated to minimising risks of bribery and corruption, as well as any issues that might come from a change in government, is key.

“You have to do deep due diligence, more so than you do in very advanced markets like Australia. You cannot afford to be fast in these markets. You have to go deep.” – KWM Co-head Private Capital Nicola Yeomans

- Take it further – form your own relationships

To deeply understand a culture of a nation, its people and its businesses, the most successful approach is to spend time in a place. To get to know the business, from its location to its management.

“You can’t just turn up, do all your meetings at Changi Airport and not go deep into the country, not really spend time with people. This is not a transactional culture. You have to go deep.” – KWM Co-head Private Capital Nicola Yeomans

This only scratches the surface of Nicola’s insights. We are watching developments in this space, including from our offices in Australia to Singapore, stretching to our many trusted partners across the region.

Want to know more? See related pieces including: