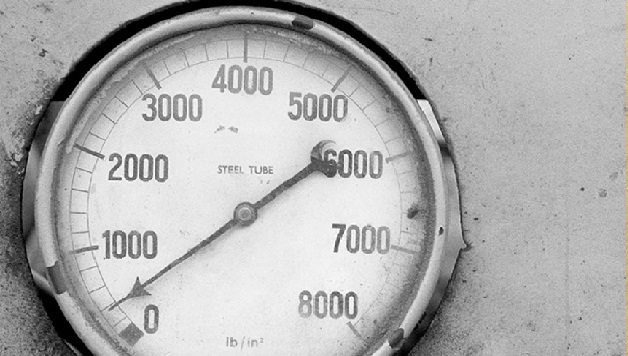

Following investigative action taken by the ACCC in 2015, the Federal Court has, yet again, broken its own record for penalties imposed under the ACL. In a warning to other companies offering wealth creation strategies that are too good to be true, the Court has ordered We Buy Houses Pty Ltd (WBH) and its principal, Richard Otton, to pay $12 million and $6 million respectively for false and misleading representations.

The orders come after Gleeson J’s judgment on liability was handed down in 2017. In that judgment, Her Honour condemned the statements made by Mr Otton and WBH, which included that consumers could “buy a house for $1”. Along with the severe penalties, both Mr Otton and the company have been permanently banned from supplying or promoting services and advice about real estate transactions or investments. Mr Otton is also prevented from managing corporations for the next 10 years.

The Conduct

The focal point of the misrepresentations by Mr Otton and the company was a book written by Mr Otton entitled, “How to Buy a House for $1” (Book). As the title suggests, it was essentially a ‘get rich quick’ scheme that sought to teach consumers about effective property investment strategies. Not only were these strategies developed in the Book, but they were also instilled at countless seminars, ‘boot camps’ and mentoring programs run by Mr Otton and WBH. There were also testimonials and websites that promoted WBH, including one from Mr Otton himself. The assurance of success in such an inaccessible market attracted large crowds to WBH’s events, and accounted for turnover of up to $20 million from 2011 to 2014. The Court found that those assurances amounted to promises for results that neither Mr Otton nor WBH could deliver.

Through the promotion and distribution of the Book’s messages, Mr Otton and We Buy Houses were found to have contravened sections 18, 29, 34 and 37 of the ACL. The misrepresentations included that consumers were able to:

(1) buy a house for $1;

(2) buy a house without needing a deposit, bank loan or real estate experience;

(3) buy a house using little or none of the consumer’s own money, including by buying at a discount;

(4) create passive income streams through property and/or quit their jobs, including by “[turning] negative gearing into positive cash flow”;

(5) build property portfolios without their own money invested and, without new bank loans or without real estate experience;

(6) start making profits immediately; and

(7) create or generate wealth.

The following tables demonstrate how broadly those representations were published, and justify the enormity of the penalties ultimately handed down by the Court:

In ordering the penalties, Gleeson J assessed the misconduct as a whole, rather than aggregating a series of smaller penalties, to reach the $12 million and $6 million figures. Her Honour’s judgment does not indicate how these numbers were calculated.

What next?

In recent times, the Federal Court and Parliament have made a concerted push for harsher penalties to be imposed for contraventions of the ACL. The Court’s record-breaking trend has been entrenched by a new penalties regime in the ACL, passed on 1 September 2018. KWM covered the changes, which increased the maximum penalties to $10 million and $500,000 per contravention[1] for corporations and individuals respectively. The Regulator too has made its stance known, with recently-reappointed ACCC boss Rod Sims saying, “We can expect [the trend of harsher penalties] to continue…”

The message from the ACCC, Federal Court and Parliament seems clear: the record for the highest penalty awarded under the ACL will be broken. We can only speculate as to when that might be, and just how much higher the Courts are willing to go. What we do know for sure is that all companies and individuals are now firmly on notice that the Court will give no sympathy to those who mislead consumers.

To track any further developments, including any details about the next (un)lucky record holders, stay tuned to KWM’s InCompetition blog.

_____________________

[1] For We Buy Houses and Mr Otton, this refers to each and every time a false and misleading representation was made, whether in the Book, on its websites or during the ‘free seminars’ they offered.

Image credit: Mark Iommi (resized and colour changed) / Australiangeographic.com.au / Flickr.com