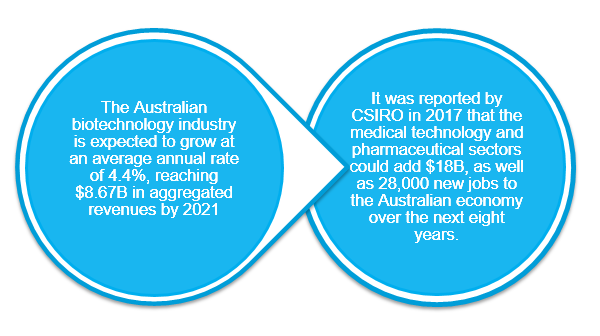

With the latest Scientific American, Worldwide Scorecard ranking Australia in the top five bio-economies globally, Australia’s biotechnology and life sciences sector continues to show healthy performance for the fifth consecutive year. Despite the challenges of the global economy, there has been generally positive sentiment from an industry that is expected to continue growing, reaching close to $8B in revenue over the current year.

In an age where phrases such as “precision medicine” and “personalised health” are increasingly becoming part of the healthcare and therapeutics narrative, innovations from within the biotechnology industry will continue to offer endless possibilities as many technologies that were once considered the stuff of science fiction become an integral part of everyday life.

The importance of the biotechnology industry to Australia’s economy was highlighted in the Australian Government’s 2018 Federal Budget, in which the Government announced a new $500M Genomics Health Futures Mission involving new clinical trials, technology development and greater community education, presenting opportunities for both businesses and research organisations to invest. The Federal Government has also established a ~$500M Biomedical Translation Fund (BTF) with $250M of government capital and $250M private sector capital to be used to invest in biomedical discoveries, particularly targeting projects at advanced pre-clinical and Phase I and II stages of development. The BTF is intended to complement the Medical Research Future Fund (MRFF), which is predicted to reach ~$20B by 2020. It is expected that funding for the Genomics Health Futures Mission will be sourced from the MRFF, representing the largest single disbursement to date from the fund.

Healthcare, medical technology and pharmaceutical innovation continue to be major areas of investment from a broad spectrum of local and off-shore funding bodies. It is estimated that over the past two years, China alone has invested ~$5.5B in Australian intellectual property and healthcare assets, and on average a third of private equity and venture capital investment deals have been in healthcare. In addition, a significant number of industry participants have also benefitted from capital raisings on the Australian Stock Exchange (ASX). 36 healthcare companies were listed on the ASX in the last three years, generating a collective total of over $5B. Together, the 160+ ASX listed healthcare companies have generated market capitalisation valued at ~$150B.

Coupled with the recent introduction of proposed legislative amendments to incentivise innovation and investment, following the Productivity Commission’s public inquiry into Australia’s intellectual property laws, there has never been a more vital time for biotechnology companies to review their Australian business strategy, including intellectual property management and enforcement strategies, to ensure they are best-positioned to exploit these recent developments.

Coupled with the recent introduction of proposed legislative amendments to incentivise innovation and investment, following the Productivity Commission’s public inquiry into Australia’s intellectual property laws, there has never been a more vital time for biotechnology companies to review their Australian business strategy, including intellectual property management and enforcement strategies, to ensure they are best-positioned to exploit these recent developments.

As many of you head off to BIO 2018, we hope you will tune in to our biotech insights program over the coming week as we report on key trends for the industry. These insights will be published on the KWM IP Whiteboard blog daily from 4-8 June, and can also be followed on LinkedIn.