Edwina Kwan, Sati Nagra and Annie Zou look at the increased risks of disputes in the carbon markets space, as new and untested issues emerge. International arbitration is an advantageous forum to resolve these disputes – and businesses should think about it now, before clashes arise.

This post originally published on the Kluwer Arbitration Blog. To read the full version, visit the blog here.

Carbon markets will play an increasingly significant role as the world transitions to a net-zero economy. A proliferation of business activities in the carbon trading space will require seismic regulatory change across global jurisdictions.

In this evolving landscape, common issues have begun to emerge including:

- practical and conceptual challenges of carbon accounting, and

- tensions between business interests in purchasing carbon offsets and government efforts to regulate carbon markets.

These new and untested issues come with a heightened risk of both commercial and investment disputes. International arbitration possesses unique features that make it well-suited as a forum for the resolution of carbon market disputes.

In this post we look at the dispute risks unfolding. And why organisations and businesses should consider opting for international arbitration as a dispute resolution mechanism.

What are carbon market disputes?

Challenges of carbon accounting

The lack of clarity in carbon accounting practices whether in a practical or conceptual sense makes it a space ripe for disputes. Ambiguity is fuelled by the lack of a standardised data collection procedure, the lack of credible and consistent emissions calculation methods, scope inconsistencies (such as supply chain inclusions) and the absence of universally recognised set of definitions.

There is increased risk that this lack of clarity may lead to exposure to:

- claims of greenwashing, misleading or deceptive conduct either in the consumer protection or financial markets space

- contractual disputes regarding the proper value and/or veracity of carbon allowances and carbon offsets

- contractual disputes involving carbon credit standards bodies.[1]

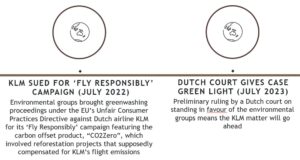

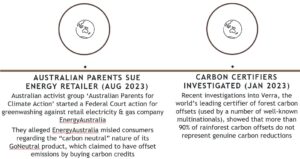

Entities worldwide have faced court action and investigations that have exposed fraudulent carbon credits, carbon credits whose benefits were exaggerated, or unsound carbon credits (based on examination of the methodologies of measuring carbon offsets).

Sources: BBC [2], Reuters [3], Women’s Agenda [4], The Guardian[5].

Even jurisdictions like Australia where a central regulatory body, the Clean Energy Regulator, is responsible for calculating abatement, is not immune from whistle-blowers and claims that the methods used by the regulator are flawed and accredit low-integrity projects with carbon credits.[6]

Carbon investment and regulatory change: emerging risks of claims for losses

Another emerging trend in carbon markets is the full or partial regulatory withdrawal from carbon credit schemes, with high concomitant risks of disputes arising from entities whose investments into the scheme have suffered alleged harm. We are witnessing this phenomenon across the world, most notably in the Canadian province of Ontario.

In July 2018 following a change in government, Ontario abruptly ended the cap-and-trade scheme that had operated briefly in the province and introduced legislation to prohibit former registered participants from trading or otherwise dealing with emission allowances and credits. This decision was supposedly motivated by the proposition that the scheme was a ‘carbon tax’ and its abolition would save taxpayer money.

However, while the legislation recommended compensating some participants, it did not compensate general market participants. As a result, two separate proceedings were filed in response to this decision – the first, by Koch Industries and the second, a class action by aggrieved businesses led by investor Sharolyn Mathieu Vettese, the president of SMV Energy Solutions. Koch Industries brought ICSID arbitration proceedings under the NAFTA against Canada,[7] claiming that the carbon allowances it purchased under this program were rendered worthless by the cancellation. Koch also claimed that Ontario wrongfully failed to compensate Koch for its loss, allegedly amounting to over US$30 million. Similar claims were made by the class action in the Canadian courts for the value of their lost investments against the Ministry of the Environment and then-environment minister Rod Phillips.[8]

Arbitration has advantages in resolving carbon-related disputes – here’s why

With a dramatic increase in the size and complexity of carbon markets, disputes arising from such carbon trading agreements are also likely to become more multifaceted. It is crucial for commercial enterprises and accrediting organisations alike to select an appropriate and sophisticated dispute resolution framework when negotiating carbon trading agreements.

Arbitration remains a viable and suitable dispute resolution mechanism for such disputes.

- Selecting arbitrators with the necessary expertise. The technicality, not only of carbon reduction technologies, but also carbon accounting and the idiosyncratic regulatory frameworks of each jurisdiction’s carbon markets means that carbon disputes are particularly complex, often requiring market-specific expertise. The ability of parties to select arbitrators and experts with relevant scientific, environmental and regulatory knowledge is a significant advantage of arbitration over other dispute resolution forums.

- Choosing a jurisdiction with apt settings. Locality and jurisdiction are often particularly important in carbon disputes. For example, the locality of the laws and regulations governing the market and the locality of the carbon offset project. These factors all contribute to arbitration being a suitable dispute resolution mechanism, especially where the local courts of the jurisdiction may be perceived to lack independence.

- Near global enforceability of awards. Many carbon disputes involve cross-border contracts and multinational entities with a global presence, who often seek to utilise the emissions reduction projects in one jurisdiction to offset certain carbon-intensive activities in another jurisdiction. Sometimes, this may involve utilising commercially beneficial carbon market schemes. The almost-universal enforceability of arbitral awards and procedural flexibility to accommodate for the legal traditions of culturally diverse counsel, parties and arbitrators is an important consideration in selecting arbitration as the dispute resolution mechanism for such contracts.

- Maintaining confidentiality. As is the case in many environmental disputes, carbon disputes have an element of public interest. At the same time, they often deal with commercially sensitive information or matters concerning national security. The ability for arbitration to maintain confidentiality by restricting public access to certain documents while opening proceedings or taking other measures to improve transparency makes it well-placed as the dispute resolution forum for carbon disputes.[9]

Institutions are already favouring arbitration as the dispute resolution mechanism for carbon contracts

While carbon markets as well as associated dispute resolution frameworks are still developing, it is apparent that there is growing appreciation of the suitability of arbitration for resolving carbon market disputes. Carbon credit standard bodies have incorporated arbitration into their standard templates for disputes with validation and verification bodies. Many institutions that publish standard form contracts for the production and delivery of carbon credits are also beginning to include arbitration as a method of dispute resolution.

In addition to commercial disputes and disputes with accrediting bodies, investment arbitration, as evident from the Koch action against Canada as an investor-state dispute settlement, is also another circumstance in which arbitration has an irreplaceable role as the forum for resolving carbon market disputes.

We are watching developments in this space. For more on carbon markets, see our Carbon page.

Footnotes

[2] Merlyn Thomas, ‘Environmentalists sue Dutch airline KLM for ‘greenwashing’’ (6 July 2022) BBC News, accessed at https://www.bbc.com/news/science-environment-61556984.

[3] Toby Sterling and Joanna Plucinska, ‘‘Greenwashing’ lawsuit against KLM to proceed, Dutch court rules’ (8 June 2023) Reuters, accessed at https://www.reuters.com/business/aerospace-defense/greenwashing-lawsuit-against-klm-can-proceed-dutch-court-2023-06-07/.

[4] Australian Parents for Climate Action Ltd v EnergyAustralia Pty Ltd (NSD833/2023); Madeline Hislop, ‘Parents sue EnergyAustralia for greenwashing over ‘carbon neutral’ marketing’ (10 August 2023) Women’s Agenda, accessed at https://womensagenda.com.au/latest/parents-sue-energyaustralia-for-greenwashing-over-carbon-neutral-marketing/.

[5] Of 94.9 million carbon credits claimed, only about 5.5 million represented real emissions reductions: Patrick Greenfield, ‘Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows’ (19 January 2023) The Guardian, accessed at https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe.

[6] Adam Morton, ‘Australia’s carbon credit scheme ‘largely a sham’, says whistle-blower who tried to rein it in’ (23 March 2022) The Guardian, accessed at https://www.theguardian.com/environment/2022/mar/23/australias-carbon-credit-scheme-largely-a-sham-says-whistleblower-who-tried-to-rein-it-in; Australian National University, ‘Australia’s carbon market a ‘fraud on the environment’’ (24 March 2022), accessed at https://law.anu.edu.au/news-and-events/news/australia%E2%80%99s-carbon-market-fraud-environment.

[7] Koch Industries, Inc. and Koch Supply & Trading, LP v. Canada (ICSID Case No. ARB/20/52).

[8] Fatima Syed, ‘Doug Ford vowed savings from cancelling cap-and-trade. Now, Ontario faces two lawsuits’ (24 January 2022) The Narwhal, accessed at https://thenarwhal.ca/ontario-cap-trade-lawsuits/; Alex Sadvari, ‘Ontario’s Cap And Trade Program Ends And Federal Backstop Looms: Implications For Ontario Businesses’ (9 October 2018) Gowling WLG, accessed at https://gowlingwlg.com/en/insights-resources/articles/2018/ontario-s-cap-and-trade-program-ends/.

[9] See also Stephen Minas, ‘COP26 Created New Carbon Market Rules: How Will Arbitration Respond?’ (23 January 2022) Kluwer Arbitration Blog, accessed at https://arbitrationblog.kluwerarbitration.com/2022/01/23/cop26-created-new-carbon-market-rules-how-will-arbitration-respond/; Global Arbitration Review, ‘Emissions trading – what role will arbitration play?’ (12 January 2021), accessed at https://globalarbitrationreview.com/emissions-trading-what-role-will-arbitration-play; Aashish Darne, ‘International Carbon Disputes – How can they be resolved through Arbitration?’ (2 June 2023) PSL Advocates & Solicitors, accessed at https://www.pslchambers.com/article/international-carbon-disputes-how-can-they-be-resolved-through-arbitration/#_ftnref3.