The School of International Arbitration at Queen Mary University of London (“QMUL”), in partnership with White & Case, recently published the 14th edition of its International Arbitration Survey, titled the ‘The Path Forward: Realities and Opportunities in Arbitration‘ (“2025 Survey”). The 2025 Survey is the most comprehensive edition to date and reports on user preferences and expectations for the future of international arbitration.[1] With an increasing number of responses from stakeholders in the Asia Pacific region as compared to earlier surveys,[2] this article examines the Asia Pacific trends deduced from the 2025 Survey and draws comparisons with results of the earlier 2021 QMUL International Arbitration Survey on ‘Adapting Arbitration to a Changing World‘ (“2021 Survey”).

The 2025 Survey identifies several overarching trends relevant to the Asia Pacific arbitration community:

- An ‘Eastward Shift’ with 4 of the top five preferred seats in the Asia Pacific region, and 3 of which are from China.

- Hong Kong is the most preferred seat in the Asia Pacific region.

- Globally HKIAC Rules and SIAC Rules tie as the 2nd most preferred institutional rules of choice.[3]

- HKIAC Rules are the most favoured in the Asia Pacific region followed closely by SIAC Rules.

- Respondents from the Asia Pacific prefer arbitration with ADR (50%) over standalone arbitration (37%).[4]

- An Eastward Shift:

To quote one survey respondent: “Arbitration is Moving East”. The Asia Pacific region is rapidly solidifying its status as an arena for international arbitration, with Beijing and Shenzhen now supplanting Paris and Geneva as preferred arbitral seats – a notable shift from the 2021 Survey.[5]

Diagram 1: Top Six Preferred Arbitral Seats Globally: 2025 Survey

The above Diagram 1 shows the latest ranking of top 2025 Survey preferred seats globally chosen by all respondents. London (34%), Singapore (31%) and Hong Kong (31%) (tied for second place), Beijing (20%), and Shenzhen (19%) and Paris (19%) (tied for fifth place) are currently the top six (6) preferred arbitral seats globally.

The results reflect the importance of established global arbitration forums. The latest figures also reveal meaningful change in the dynamic Asia Pacific region. The continued rise in popularity of key Asian arbitral hubs is a notable global trend over recent years.[6] This is particularly so for Hong Kong and Singapore, both with longstanding international arbitration presence and recognition as ‘safe seats’, the 2025 Survey firmly cements their standing as highly desirable seats of choice.

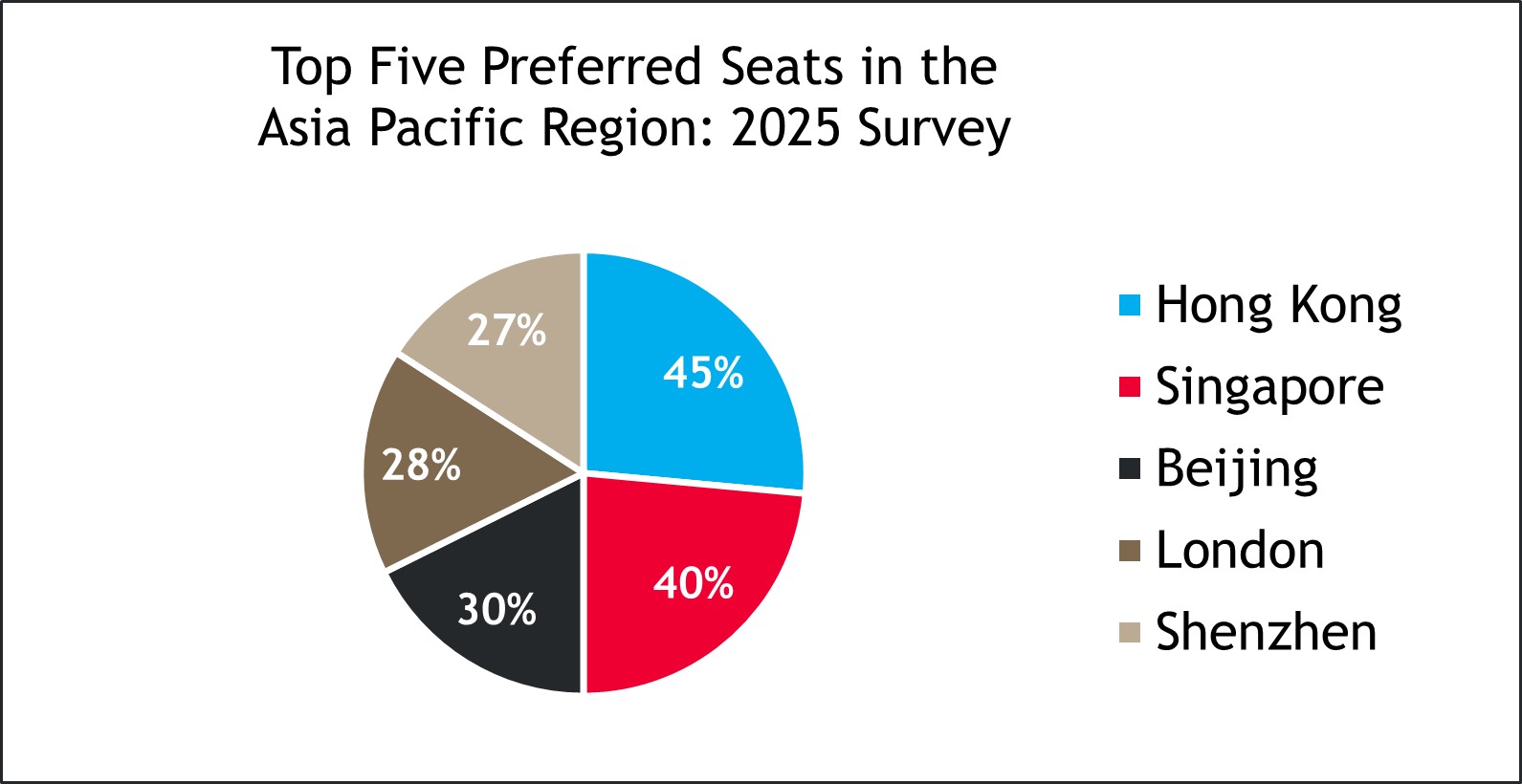

Taking an Asia Pacific focus, i.e. on survey respondents primarily practising in the Asia Pacific, the 2025 Survey revealed a nuanced approach within the region with Hong Kong (45%) as the most preferred seat, closely followed by Singapore (40%), Beijing (30%), London (28%) and Shenzhen (27%) to complete the top five (5) seat preferences. See below Diagram 2.

Diagram 2: Top Five Preferred Seats in the Asia Pacific Region: 2025 Survey

Notably Shenzhen replaced Paris in the top five seat preferences for Asia Pacific in the 2025 Survey, as compared to the 2021 Survey.[7] The figures in the 2025 Survey reflect the growing influence of Mainland China arbitration centres, with Hong Kong also overtaking Singapore as the top preference among Asia Pacific users.

As reported in the latest 2024 HKIAC Statistics, of the new arbitration filings received by HKIAC in 2024, over 65% arose from contracts signed in 2020 or later, and over 40% from contracts made in 2022 or later, suggesting a potentially long-term nature of this Eastward shift in arbitration.

- Competitive Arena for Preferred Asia Pacific Arbitral Institutions

Both 2021 and 2025 Surveys track arbitration users’ preferences in choice of arbitral institutions and their rules. Globally, ICC Rules[8] remained the most preferred global choice in the 2025 Survey (39%), albeit its preference margin has narrowed as compared to the 2021 Survey (57%).[9]

The second most preferred rules globally reported in the 2025 Survey were HKIAC Rules[10] and SIAC Rules,[11] both with 25% of the vote. This represents a shift from the 2021 Survey, when SIAC (49%) held a slight lead over HKIAC (44%).[12] LCIA Rules[13] took the third place for the 2025 Survey (22%). The fourth most preferred set of rules was jointly the UNCITRAL Arbitration Rules and the CIETAC Rules (both 15%) in the 2025 Survey.

Asia Pacific Regional Picture:

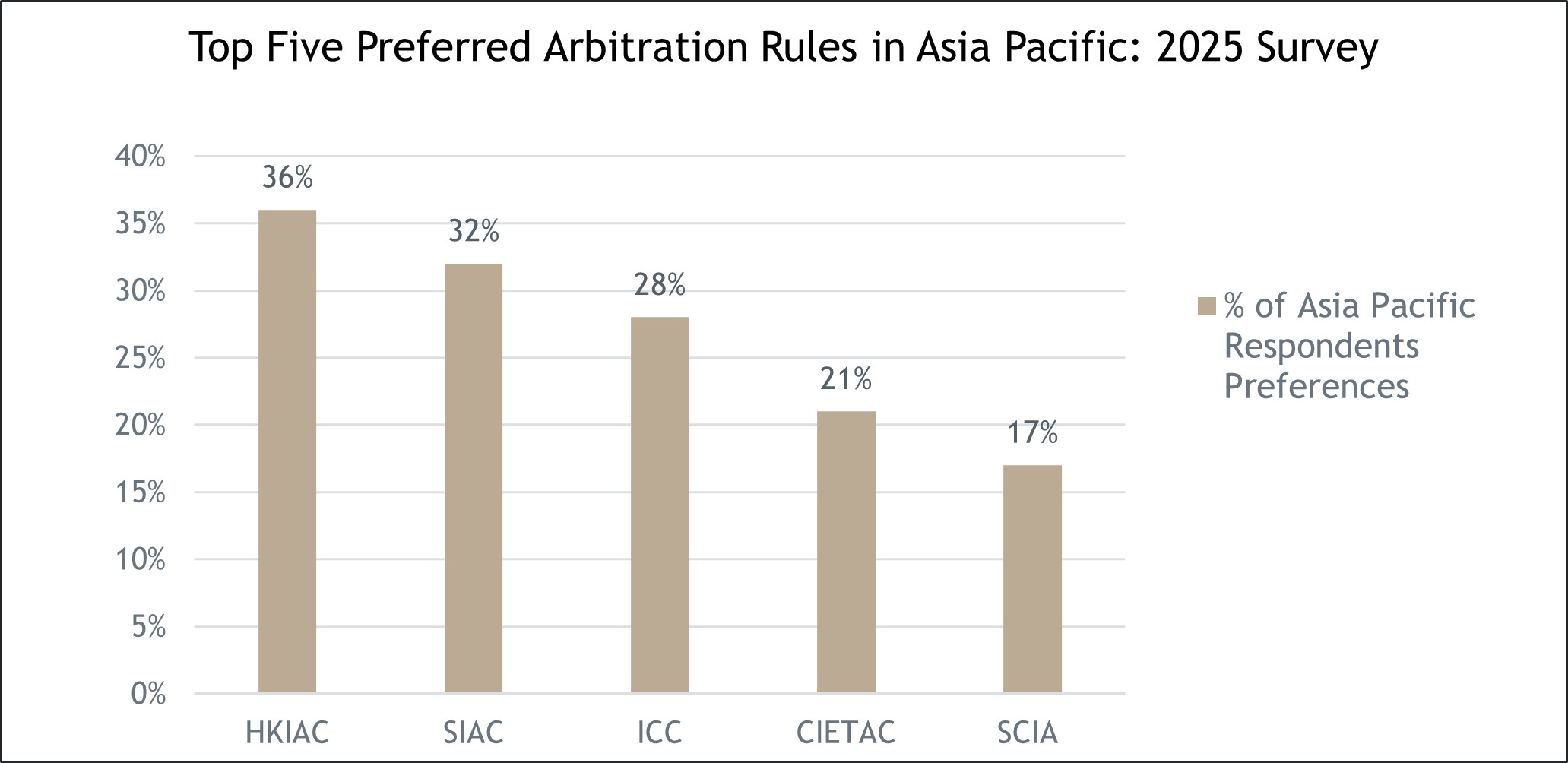

Among the Asia Pacific respondents in the 2025 Survey, HKIAC Rules were the most favoured (36%) followed closely by SIAC Rules (32%); ICC Rules were in third position (28%); CIETAC Rules[14] took fourth spot (21%); and with SCIA Rules[15] (17%) completing the top five. See Diagram 3 below:

Diagram 3: Top Five Preferred Arbitration Rules in Asia Pacific: 2025 Survey

HKIAC Rules were particularly recognised for their innovative features, notably HKIAC Secretariat’s ‘light touch’ approach, with its effective handling of administrative functions, particularly in sanction-related disputes.[16] Access to the unique Interim Measures Arrangement[17] was cited as a particular advantage of HKIAC Rules when an arbitration may need the support of interim measures, or contemplates award enforcement in Mainland China.[18]

The 2025 Survey preference for HKIAC Rules as the arbitration rules of choice within the Asia Pacific region[19] marks a departure from the 2021 Survey, where respondents in the latter showed a broader preference for various institutions.[20] The growing impact of sanctions on arbitration proceedings have also contributed to the Asia Pacific region’s rising prominence. Notably, 30% of practitioners with experience of such cases reported selecting a different arbitral seat to ensure their dispute could be arbitrated, frequently opting for Hong Kong and Singapore as preferred alternatives.[21]

- Asia Pacific Preferences:

Hybrid Dispute Resolution:

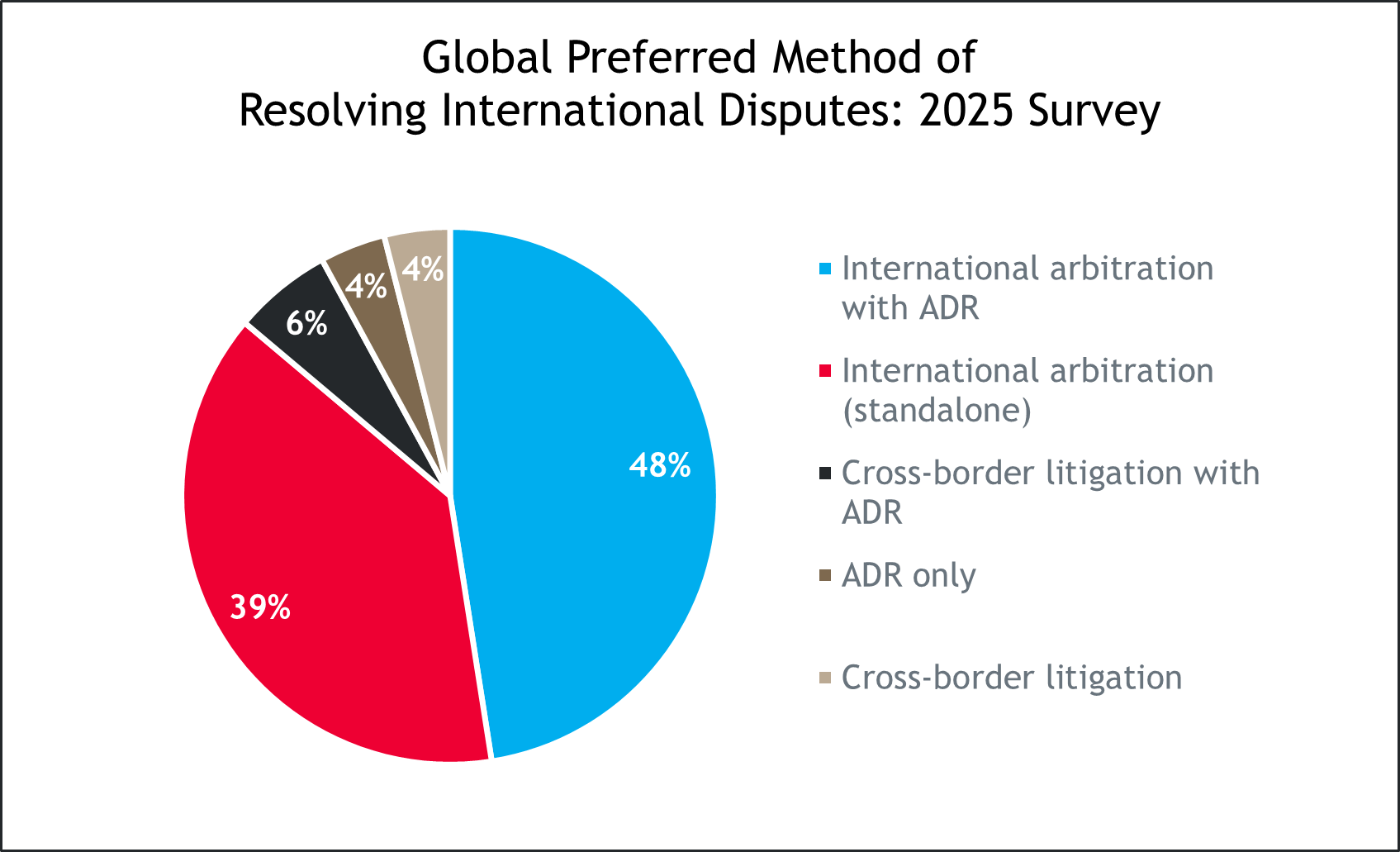

Globally, international arbitration continues to dominate as the preferred dispute resolution mechanism for cross-border disputes in the 2025 Survey, with 87% of respondents endorsing its use, either as a standalone mechanism (39%) or in conjunction with Alternative Dispute Resolution (“ADR”) (48%) (as set out at Diagram 4 below).[22] This marks a modest rise in preference for international arbitration as a standalone mechanism (previously 31%) and a decline in preference for international arbitration with ADR since the 2021 Survey (previously 59%).[23]

Diagram 4: Global Preferred Method of Resolving International Disputes: 2025 Survey

Collaborative Approach:

Regional trends reveal that Asia Pacific respondents in the 2025 Survey tended to favour a more collaborative approach to dispute resolution, preferring arbitration with ADR (50%) rather than standalone arbitration (37%).[24] This was further reflected with Asia Pacific respondents in the 2025 Survey raising concern over “the negative impact of counsel adopting adversarial rather than collaborative approaches” during arbitration proceedings.[25]

Opposition to the Enforceability of Annulled Awards:

The 2025 Survey invited stakeholders to comment on their in-practice experiences with the voluntary compliance of arbitral awards by award debtors. The findings suggest more frequent voluntary compliance when the award debtor is a private entity or individual. Expectations of voluntary compliance from state entities for both ICSID and non-ICSID arbitrations were slightly lower.[26] Views were also sought on whether awards set aside, annulled or suspended at the seat should be enforceable in other jurisdictions. Globally, a clear majority of respondents in the 2025 Survey disagreed with the suggestion. Regionally, Asia Pacific respondents were also more firmly opposed to the proposal (64%) than for other regions (54 to 58%).[27]

Openness to AI?

With its potential for efficiency gains and reduction of human oversight errors, respondents in the 2025 Survey expect the use of AI in international arbitration to grow significantly over the next 5 years.[28] AI has emerged as a focal point in discussions on the future of international arbitration.[29] Currently, the most common uses of AI are for conducting factual and legal research, document review, and data analytics.[30]

Asia Pacific respondents appear more confident in the capacity of AI to accelerate arbitration (55%) as compared to those based in Europe (30%).[31] Alongside speed, globally respondents in the 2025 Survey expect the emergence of new roles dedicated to managing and implementing AI (40%), and the reduction in arbitration costs (25%).[32]

Reservations towards AI:

Enthusiasm for AI is tempered by caution. As the 2025 Survey explores, while AI may be effective for certain tasks, its current limitations in handling complex legal drafting remain a concern.[33] The greatest deterrents to increased reliance on AI in international arbitration include unease over errors and bias (risk of hallucinations), confidentiality risks, lack of experience, and regulatory gaps.[34] Respondents in the 2025 Survey generally accepted the use of AI by arbitrators in drafting procedural orders and non-dispositive positions of awards or decisions (60%).[35] However, strong opposition emerged in respect to the use of AI in drafting legal reasoning portions of awards and decisions (only 23% approval).[36]

A Push for Efficiency and Effectiveness:

Inefficiency is a known challenge in international arbitration. This recent 2025 Survey finds that inefficiency largely stems from adversarial tactics employed by counsel (24%), arbitrators’ lack of proactive case management (23%), and over-lawyering (22%).[37]

The 2025 Survey records that expedited arbitration procedures are gaining traction amongst respondents by reason of cost effectiveness, a quick outcome, and opportunity to design bespoke expedited procedural frameworks.[38] Respondents recognised that the success of expedited arbitration procedures is contingent on the tribunal’s willingness to make quick decisions.[39] Beyond this, mechanisms such as early determination for manifestly unmeritorious claims and consolidation or joinder (specifically in multi-party or multi-agreement disputes) were viewed as promising tools for streamlining arbitration proceedings.

In this context, with a bold stride towards enhanced efficiency and flexibility, HKIAC introduced its 2024 Administered Arbitration Rules (2024 Rules), which include provisions for a hard-stop time limit for the close of proceedings (45 days from the last oral or written submissions) and issuance of an award (3 months from the close of proceedings), underscoring its commitment to swift and effective arbitration procedures. The latest SIAC Rules 2025 also include the introduction of a further streamlined procedure for claims of under S$1 million designed to provide a more efficient and cost-effective option for low value and less complex disputes.

Key Takeaways:

The latest 2025 Survey highlights the evolving global arbitration landscape with an increasing Asia Pacific nexus.

Hong Kong and Singapore continue to be robust powerhouse arbitration seats and popular institutional choices which adapt to new challenges and growing user demands.

In parallel, the notable rise of China Mainland arbitral centres, namely Beijing, Shanghai and Shenzhen, marks a shift in influence to the East.[40]

Looking ahead from the 2025 Survey, the Asia Pacific region is poised to play a progressively significant part in shaping the future of international arbitration.

For other related commentary, please read our articles on the HKIAC 2024 Rules here, and the SIAC Rules 2025 here.

The authors would like to thank Lydia Daly for her invaluable assistance in preparing this article.

[1] Page 1 [para 2] in the 2025 Survey notes the widest ever pool of survey respondents (2,402 questionnaire responses) – nearly double that contributing to the 2021 Survey.

[2] Survey respondents were invited to identify the geographical regions in which they principally practise or operate. 47% of survey respondents included Asia Pacific as a region in which they principally practice or operate in the 2025 Survey [page 37], as compared to 43% of survey respondents who selected Asia Pacific in the 2021 Survey [page 35]. Survey respondents were able to select multiple regions.

[3] Page 10 [Chart 5] in the 2025 Survey.

[4] Page 8 in the 2025 Survey. As compared to Europe-based respondents who preferred standalone arbitration (51%) over arbitration combined with ADR (42%) in the 2025 Survey.

[5] Page 8 [para 6] in the 2021 Survey reported the top five preferred arbitration seats as London (54%), Singapore (54%) Hong Kong (50%), Paris (35%) and Geneva (13%) – respondents were allowed to make up to 5 selections.

[6] Page 6 in the 2021 Survey commenting on 2015, 2018, and 2021 QMUL International Arbitration Survey Reports.

[7] Page 6 [Chart 2] in the 2025 Survey: Top five most preferred seats by region, as compared to 2021 Survey with Singapore (74%), Hong Kong (71%), London (50%), Beijing (19%) and Paris (15%) as the top five most preferred Asia Pacific seats.

[8] Rules of Arbitration of the International Court of Arbitration of the International Chamber of Commerce (“ICC Rules”): https://iccwbo.org/dispute-resolution/dispute-resolution-services/arbitration/rules-procedure/.

[9] Noting that the 2021 Survey recorded responses on the most preferred institution, being ICC at 57%, rather than the preferred set of arbitration rules as in the case of the 2025 Survey.

[10] Hong Kong International Arbitration Centre Rules (“HKIAC Rules”): https://www.hkiac.org/arbitration/rules-practice-notes.

[11] Rules of the Singapore International Arbitration Centre (“SIAC Rules”): https://siac.org.sg/siac-rules-2025#.

[12] As mentioned above, noting that the 2021 Survey records responses on the most preferred institution, rather than the preferred set of arbitration rules as in the case in the 2025 Survey.

[13] London Court of International Arbitration (“LCIA”) Rules: https://www.lcia.org//Dispute_Resolution_Services/lcia-arbitration-rules-2020.aspx.

[14] China International Economic and Trade Arbitration Commission (“CIETAC”) Rules: https://www.cietac.org/en/category/rules-guidelines.

[15] Shenzhen Court of International Arbitration (“SCIA”) Rules: https://en.scia.com.cn/ArbitrationRules.html.

[16] Page 10 [para 1] in the 2025 Survey.

[17] The Arrangement Concerning Mutual Assistance in Court-ordered Interim Measures in Aid of Arbitral Proceedings by the Courts of the Mainland and of the Hong Kong Special Administrative Region (in force 1 October 2019) (the “Interim Measures Arrangement”) (https://www.hkiac.org/arbitration/arrangement-interim-measures); and the Supplemental Arrangement Concerning Mutual Enforcement of Arbitral Awards between the Mainland and the Hong Kong Special Administrative Region (in full force 19 May 2021) (Hong Kong Department of Justice – Arrangements with the Mainland).

[18] Page 10 in the 2025 Survey.

[19] Pages 8 to 9 [para 11] in the 2025 Survey.

[20] Page 9 [para 5] in the 2025 Survey; page 11 in the 2021 Survey. As mentioned above, noting that the 2021 Survey records responses on the most preferred institution, rather than the preferred set of arbitration rules as in the case in the 2025 Survey. HKIAC ranked third in 2021 in the Asia Pacific region, i.e.: SIAC (64%), ICC (46%), LCIA (30%), HKIAC (30%), and CIETAC (25%).

[21] Page 10 [para 7] in the 2025 Survey.

[22] Page 5 [para 2] in the 2025 Survey.

[23] Page 5 [para 2] in the 2025 Survey.

[24] Page 6 [para 2] in the 2025 Survey.

[25] Page 16 in the 2025 Survey. 23% of Asia Pacific Respondents consider that the most negative behaviour impacting efficiency in counsel focusing on adversarial rather than collaborative approaches.

[26] Page 12 in the 2025 Survey.

[27] Page 13 [para 4] in the 2025 Survey.

[28] Page 27 in the 2025 Survey.

[29] Page 27 in the 2025 Survey.

[30] Page 27 [para 4] in the 2025 Survey.

[31] Page 33 [para 4] in the 2025 Survey.

[32] Page 33 [para 5-6] in the 2025 Survey.

[33] Page 28 [para 2] in the 2025 Survey.

[34] Pages 27 – 30 in the 2025 Survey: Arbitration and AI.

[35] Page 32 [para 2] in the 2025 Survey.

[36] Page 32 [para 3] in the 2025 Survey.

[37] Page 15 [para 3] in the 2025 Survey.

[38] Pages 18 [para 3] to 19 in the 2025 Survey: Efficiency and effectiveness.

[39] Page 15 [para 6] in the 2025 Survey.

[40] Page 8 in the 2025 Survey. Beijing is now at 4th place globally ahead of Paris. Shenzhen is now at 6th place and Shanghai is in 8th position as most preferred seats globally.