Caroline Hayward and Evan Manolios set out the anti-money laundering and counter-terrorist financing (AML/CTF) reform coming to the legal sector. The changes will be significant and for some, hard to implement.

This post gives a snapshot of the proposed AML/CTF reforms to the legal sector (Part A) before exploring a few specific issues that arise in the legal sector (Part B). These changes are likely to affect a large swath of individual lawyers and law firms. Based on our experience in other markets, these changes will require multiple practical, technical and compliance uplifts, as well as clear communication with clients and staff members. Read on for the latest in KWM’s inhouse-centred series: From our inhouse to yours.

Part A – the “why”, “when” and “what”?

Why AML/CTF reform?

AML/CTF reform is needed in Australia. Australia lags behind other countries in its framework to combat money laundering / terrorist financing (ML/TF) in the legal sector. Australia is one of only five countries that does not comply with FATF[1] recommendations regarding the regulation of what FATF calls “designated non-financial business and professions” or what the Attorney-General calls “Tranche 2 entities” or “professional service providers”. This group includes lawyers, accountants, real estate agents and custodian service providers.

Why does this matter I hear you say? The short answer is non-compliance with FATF recommendations has significant consequences. Australia’s compliance is slated to be reviewed in 2026-2027 as part of FATF mutual evaluation of Australia. Failure to materially adhere to FATF standmards means Australia could appear on FATF’s ‘grey list’. This in turn has tangible economic impacts. It can lead to reduced foreign investment in Australia, challenges to correspondent banking relationships that enable cross-border transactions and difficulty for foreign persons doing business with Australia.

There are also more substantive arguments that reform is needed to combat the specific ML/TF risks associated with the legal sector. We do not propose to weigh in on the policy arguments – sector specific vulnerabilities and risks associated with ML/TF in the legal industry are addressed in the Attorney General’s Consultation Papers (described below).

When is the AML/CTF reform?

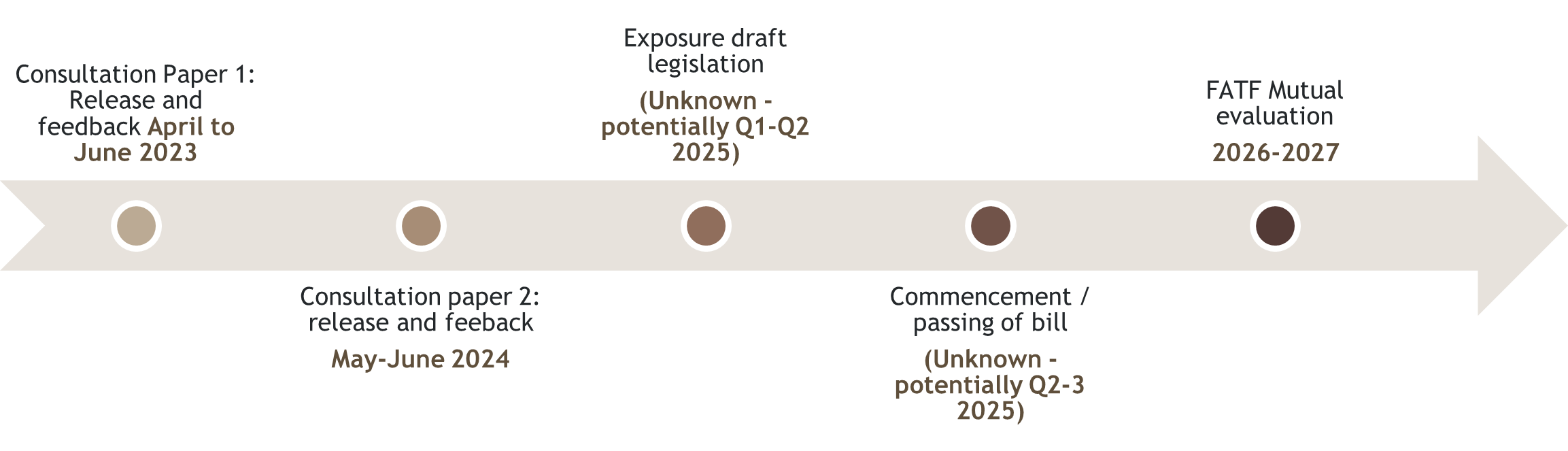

We are still in the early stage of this reform package. The Attorney General has conducted two rounds of public consultation, each seeking industry feedback (see here for 1st round consultation feedback. See here for the 2nd round consultation information).

From here, we expect a draft bill to amend the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) and its associated rules. The diagram below should what’s happened, and what to come.

What is the AML/CTF reform?

AML/CTF legal sector reforms are part of a broader suite of changes and amendments to the AML/CTF Act. Our AML/CTF team wrote about some more of those here.

Lawyers and law firms that provide certain “designated services” will be considered “reporting entities” and subject to the key statutory AML/CTF obligations under the AML/CTF Act and associated rules. There are 8 proposed designated services, details of which are set out in the Attorney-General’s 2nd Consultation Paper. At a high level, “designated services” include the following types of legal services:

- buying and selling of real estate

- managing of client money, securities or other assets

- management of bank, savings or securities accounts

- organisation of contributions for the creation, operation or management of companies

- creation, operation or management of legal persons or legal arrangements (eg trusts)

- buying and selling of business entities.

A close assessment of the designated service scope will be necessary to ascertain if a law practice falls within a “designated service”. For example, litigation, some types of advice, in-house services are not intended to be captured.

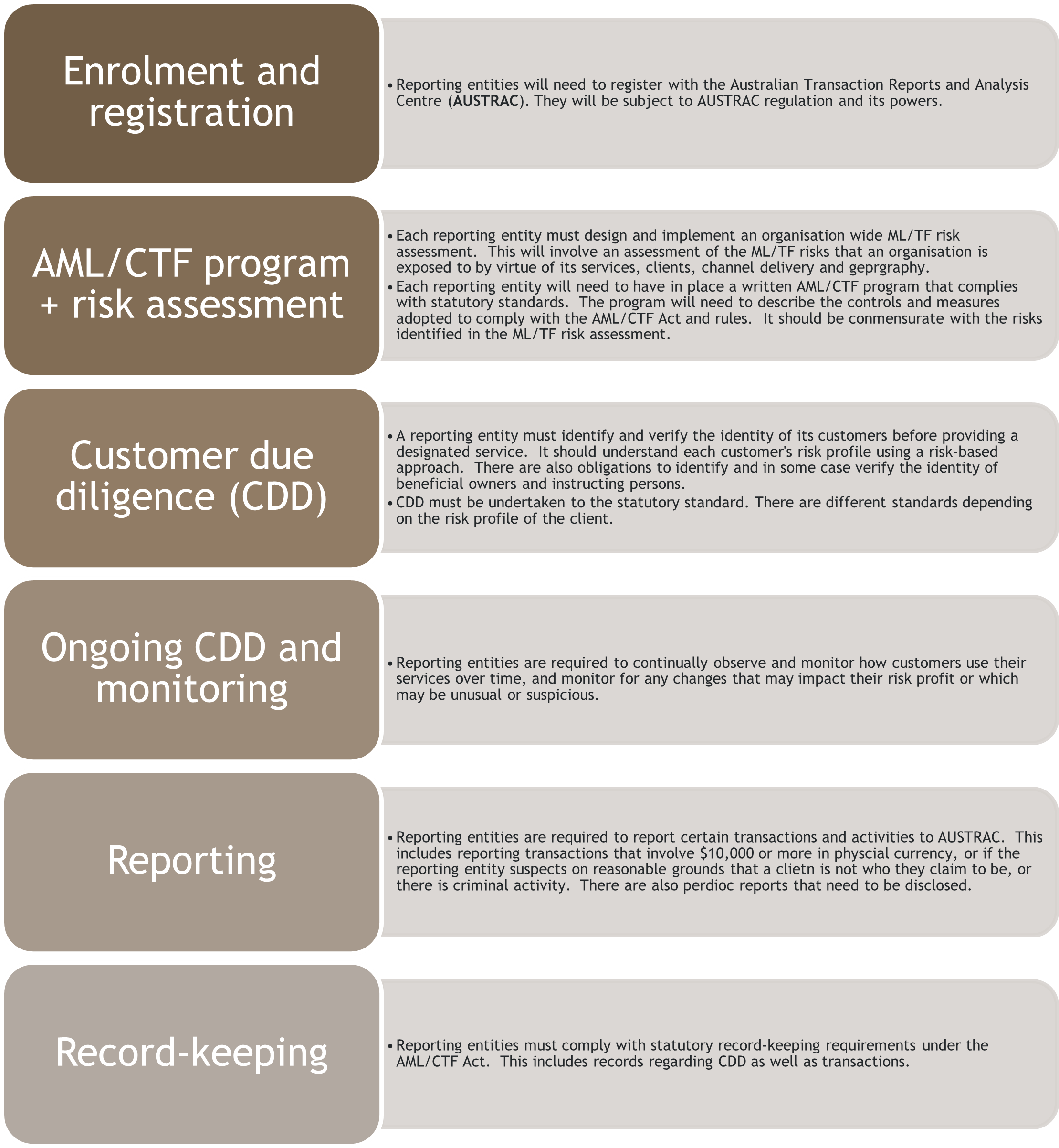

Precise details remain scant and will likely remain that way until the proposed bill is seen. An outline of the key legal and regulatory requirements is set out below.

There are also additional requirements regarding personnel, training and audits which will need to be satisfied.

Part B: AML/CTF issues specific to the legal industry

AML/CTF compliance in the legal space is likely to throw up several issues unique to the legal sector. We give a flavour of several of these below. For many of these, there is not yet a resolution on its proposed treatment as part of the reforms.

- Scope of regulation

There is a subtle but important question as to whether the requirements under the AML/CTF Act apply to individual lawyers or to the organisations that provide legal services, or both. In cases of sole practitioners, this distinct is irrelevant, but it may have significant implications for law firms and individual lawyers. On one hand, compliance at an individual level will help to promote awareness and compliance at an individual level. It will mean that a solicitor is subject to specific statutory obligations, akin to complying with solicitors conduct rules. On the flipside, for a law firm, practically speaking compliance is required at an enterprise level (eg AML/CTF programs) so this too makes sense.[2]

- Who will be the regulator?

AUSTRAC is Australia’s AML/CTF regulator and financial intelligence unit. It ensures reporting entities comply with their AML/CTF obligations, including periodic and suspicious transaction reporting.

There has been feedback from the consultation papers as to whether the applicable State law societies should oversee or at least be involved in AML/CTF compliance, as an extension of their supervisory role over solicitors and the legal sector. The experience in other jurisdictions is mixed – New Zealand has a government department as AML/CTF regulatory, while the UK, Ireland and Hong Kong all adopt the law society as the applicable AML/CTF regulator.

- Legal professional privilege / confidential information

The interaction between AML/CTF compliance and legal professional privilege (LPL) is the one area that is unique to the legal sector. There remains a legitimate concern as to how AML/CTF obligations will interact with LPL, and how and when it will be maintained.

This is specifically the case in respect of mandatory suspicious matter reporting (SMRs), which may potentially involve a disclosure of legal advice and waiver of LPL. This involves complex examination of the existing legislative requirements and the underlying principles of LPL to ensure there is a balance of maintaining LPL while ensuring ML/TF risks are appropriate addressed. This is a fresh issue for Australia as (unlike in many other jurisdictions) not everyone on the street has a duty to report suspicious activity through an SMR. These reforms will bring lawyers into the scope of reporting entities.

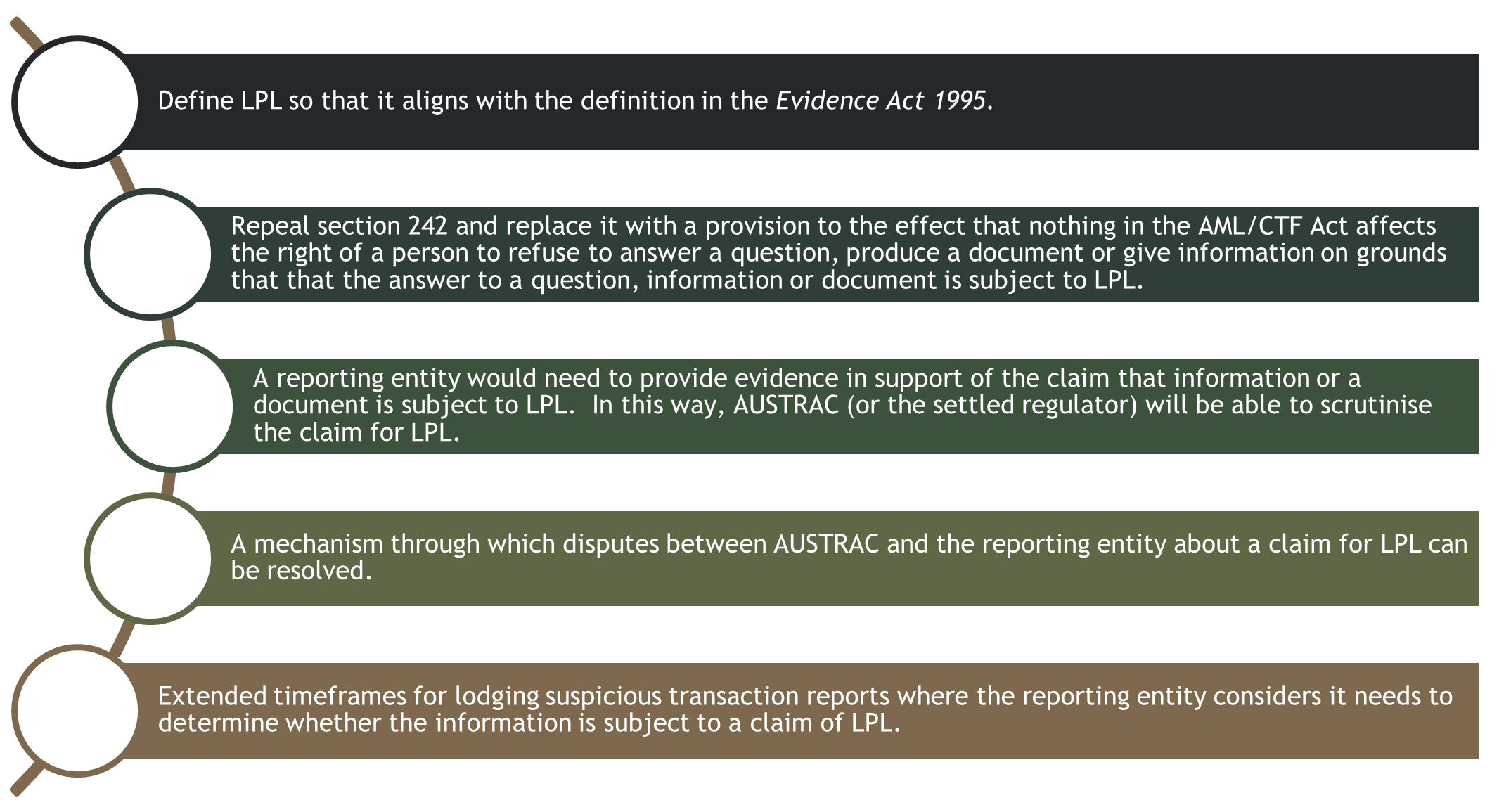

LPL is currently protected by section 242 of the AML/CTF Act. That section states that the AML/CTF does not affect the law relating to LPL. The Attorney-General’s department has accepted that change is needed, and has proposed the following changes:

It is also proposed that documents or information disclosed to AUSTRAC or government bodies pursuant to the AML/CTF Act will not lose its confidential nature should a third-party request disclose of the information.

Conclusion: where to from here?

There remains a lot of uncertainty around how in practice lawyers and law firms will comply with their new obligations, as further detail unfolds. There is the promise of industry specific guidance, which will no doubt help. We encourage our fellow colleagues in the industry to participate in relevant consultations and discussions.

From an individual solicitor’s perspective, it will be important to see how the new regime adds or augments existing solicitors’ rules and obligations. In our experience, a key experiential change is to matter opening , which can take more time when requesting information and materials. Thankfully, many clients are already familiar with this process as the FATF standards for lawyers have made their way around the world.

Our AML/CTF experts have a wealth of experience on advising on AML/CTF compliance, and building out AML/CTF programs. We would be happy to discuss.

Stay tuned as there is more to follow.

If you or someone in your organisation needs further guidance on this topic, please reach out to your KWM contact or Urszula McCormack and Kate Jackson-Maynes.

[1] FATF being the Financial Action Task Force, the multinational financial crime watchdog.

[2] On a connected note, there has also been feedback that existing solicitors ethical rules and trust accounting requirements already serve as controls to ML/TF, and accordingly regulation in the legal sector is either not necessary or can be less (given existing controls).