Canada’s Competition Bureau announced that it will publish monthly reports of concluded mergers, as part of its “ongoing efforts to increase transparency”. The monthly reports provide information on the parties to a transaction, the relevant industry within which the transaction occurred and the outcome of the Bureau’s review. The Bureau published its first entry on the merger register on 9 March 2012.

Shortly after, on 23 March 2012, the Bureau published two draft Pre-Merger Notification Interpretation Guidelines for public consultation:

- Interpretation Guideline No 12, which is intended to clarify the Bureau’s policy where a pre-merger notification and/or Advanced Ruling Certificate request has been made, but the transaction is then altered in some way before clearance while the investigation is still in progress; and

- Interpretation Guideline No 14, which is concerned with duplication arising from “affiliate transactions”, in the context of measuring whether a proposed transaction reaches the threshold for mandatory notification to the Bureau. This involves calculating the monetary value of the parties’ assets in Canada or the gross revenues derived from sales “in, from, or into” Canada generated by the assets (sections 109 and 110 of the Competition Act).

The launch of the merger register has been somewhat controversial. In particular, concerns have been expressed that the register will undermine confidentiality. In a letter to the Senior Deputy Commissioner of Competition, the Canadian Bar Association questioned whether the Bureau, without the parties’ permission, could disclose the identity of the parties or other details about a merger, where it had not been made public that a proposed merger had been reviewed by the Bureau. The Bar Association pointed to section 10 and 29 of the Competition Act which require certain inquiries to be dealt with by the Commissioner in private and prohibit direct or indirect communication of certain information. Other commentators have questioned whether the register will advance, in any meaningful way, the Bureau’s goal to increase transparency.

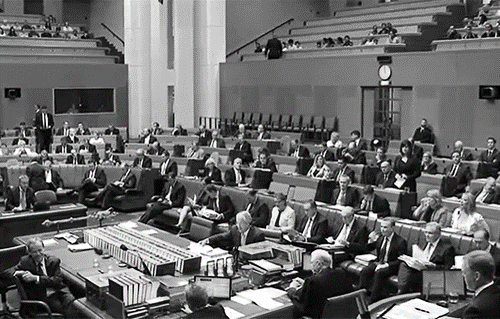

The ACCC publishes lists of all formal and public informal merger clearances under consideration, as well as matters that are being monitored, here.

Photo credit: Christopher Policarpio / Foter.com / CC BY