David Olsson highlights the transformative opportunities emerging from China’s cleantech investments, as detailed in a recent report by Climate Energy Finance. What’s next for Australian businesses?

Between early 2023 and late 2024, China’s cleantech investments worldwide exceeded US$100 billion. These investments span multiple sectors and continents from Africa to the Americas – highlighting China’s dominant role in the clean energy transition. Yet only a small portion of this capital has been directed toward Australia, representing a missed opportunity for economic cooperation.

The estimate – contained in a new report by Australian think tank Climate Energy Finance (CEF) – shows how China is dominating in research and development, investment and export of clean energy technologies that include solar, wind and batteries.

Despite China’s massive global push, Australia attracted only a fraction of this investment – US$613 million in 2023, a multi-decade low. However, 2024 has seen promising signs of renewed interest, particularly in the cleantech space, with increased Chinese investments in Australian renewable energy and battery projects.

The CEF report highlights the opportunities for Australia to grow green technology and sustainable practices, providing a roadmap for international collaboration. The report calls for strategic measures to incentivise Chinese private investment in Australian cleantech, while protecting national interests.

Here are four trends identified by the report – and striking infographics that demonstrate them.

Key takeaways from the CEF report on China’s global cleantech investments

- China’s world-leading cleantech investments

China’s investment in clean technology, research, development and manufacturing now surpasses that of the US and the EU combined. With leading-edge advancements in solar panels, EV supply chains and grid technology, China cleantech investments are driving domestic growth and supporting global efforts to achieve net zero emissions.

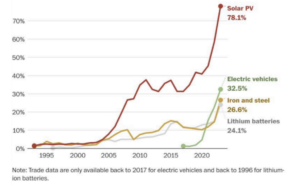

Source: UN Comtrade Database as cited in CEF report, Green Capital Tsunami

- Costs of cleantech are falling globally

China’s scale of cleantech production has driven down costs globally, particularly for solar modules and batteries, reshaping global trade dynamics. For Australia, this represents a time-critical opportunity to accelerate its own energy transition by leveraging lower costs and China’s advanced technologies.

Source: Financial Times as cited in CEF report, Green Capital Tsunami

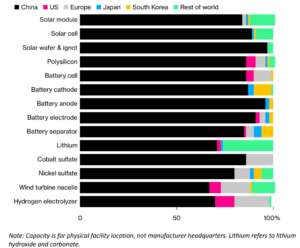

- Wind, solar, grid technology and batteries are areas of strength

China is rapidly expanding its leadership in wind, solar, and battery technologies, exporting expertise and infrastructure to regions such as South America and ASEAN. It leads in global hydro-electric dam construction and operation, with significant projects across Africa and Asia.

Its dominance in the battery supply chain, and the establishment of manufacturing capacities world wide are also helping to circumvent global trade barriers while supporting global decarbonisation efforts.

Source: Bloomberg NEF as cited in CEF report, Green Capital Tsunami

What’s next for Australian businesses?

- Stay informed: To stay competitive, Australian businesses should actively monitor China’s evolving cleantech investment strategies through industry-specific reports, government updates, and participation in business forums. This proactive engagement will allow firms to identify emerging opportunities and align them with their decarbonisation and growth strategies. (For our regular insights, subscribe to KWM Pulse using the button below!)

- Seek strategic partnerships: Under the new Future Made in Australia legislation, Australian businesses now have a framework under which to explore joint ventures, partnerships and other business ventures with Chinese firms to leverage their expertise in renewables and cleantech. These collaborations offer the potential to accelerate onshore production while balancing the need for foreign capital with national security considerations. Carefully structured agreements can ensure Australian firms retain control of critical assets while benefiting from the capital and technology that Chinese firms offer.

- Leverage decarbonisation momentum: With China driving so much of the global clean energy transition, Australian businesses have a timely opportunity to accelerate their own decarbonisation initiatives. By tapping into China’s expertise in areas such as renewable energy and battery technologies and leveraging Australian government incentives from the Clean Energy Finance Corporation and ARENA, firms can unlock new commercial opportunities while meeting their sustainability targets.

- Promote sustainable practices: As businesses engage with China’s cleantech sector, any partnerships should align with global sustainability goals and rigorous ESG standards. By embedding responsible practices and transparent reporting, companies can attract sustainable investment, create long-term value, and contribute meaningfully to both local and global climate targets.

- Consider geopolitical and supply chain risks: China’s dominant and critical role in global supply chains and its importance as Australia’s number one trading partner cannot be underestimated. Businesses will, however, need to evaluate geopolitical and supply chain risks, according to their own business strategies and risk appetite. As global trade policies shift, particularly in the US and the EU, ensuring business continuity through supply chain resilience will need to be front of mind for business leaders. China’s dominance in decarbonisation is not just a competitive reality but a collaborative opportunity. By aligning with China’s cleantech advancements, Australia can significantly enhance its green future.

Read more of David’s views on how Australia can benefit in his oped in The Australian Financial Review.