Caroline Chong, Jessica Waters and Tamara Hunter unpack the recent Full Court of the Federal Court decision concerning unfair contract terms in ASIC v Auto & General Insurance Company Limited [2025] FCAFC 76.

The recent Full Court of the Federal Court decision of Australian Securities and Investments Commission v Auto & General Insurance Company Limited [2025] FCAFC 76 is the first Full Court decision to closely examine the proper construction of notification terms which are so fundamental to insurance contracts, and the interplay between the unfair contract terms (UCT) regime under the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) and certain consumer protection provisions of the Insurance Contracts Act 1984 (Cth) (IC Act) post the Hayne Royal Commission reforms.

The Full Court ultimately upheld the primary judge’s conclusion that the notification term (see below) was not unfair, but based on a different interpretation of the clause, which implied a level of materiality into the clause. While each case will turn on its facts, the outcome reflects a general trend (both in regulator enforcement and private actions) where, upon challenge by the defendant, courts have been increasingly finding the impugned terms not unfair.

Key takeaways

- A consumer lens is key: The proper construction of a standard form consumer insurance contract term requires considering what a reasonable consumer would understand the term to mean, not what a reasonable businessperson would understand it to mean.

- Courts can infer a ‘materiality criterion’ to avoid absurdity: The proper construction of a notification term requiring insureds to ‘tell us if anything changes about your home and contents’ was qualified by a criterion of materiality relating to the insured risk. That is, the insured needs to notify of changes material to the insured risk, not any and all changes.

- Transparency is important, but lack of it may not be fatal: Transparency must be considered for each of the three limbs of the unfairness test. While lack of transparency could on its own support a finding that the term is not reasonably necessary to protect a legitimate interest, lack of transparency in itself may not necessarily render a term unfair. In this case, although there was some lack of transparency, the term was still reasonably necessary to protect a legitimate interest.

- Statutory protections help, but won’t save poor drafting: Duties created under provisions such as section 13 (duty to act in good faith) and section 54 (which place restrictions on when an insurer can refuse to pay claims) of the IC Act are to be implied into contracts of insurance and may affect how an insurer exercises its rights under the impugned term. However, such provisions do not immunise insurance contracts from the unfair contract terms regime.

The case in a nutshell

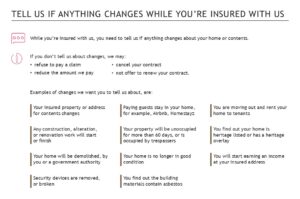

The case concerned a standard form home and contents insurance contract issued by Auto & General, and a ‘Notification Term’ requiring insureds to inform the insurer ‘if anything changes while you’re insured with us’ (Notification Term).

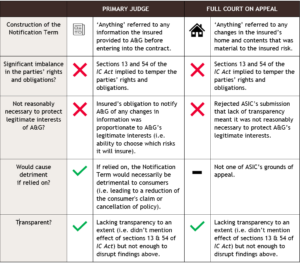

In April 2023, ASIC commenced proceedings against Auto & General in the Federal Court, alleging that the Notification Term was unfair within the meaning of section 12BG(1) of the ASIC Act. ASIC contended that the Notification Term imposed an unreasonable and unclear burden on consumers, given that it went beyond insureds’ general disclosure obligations as set out under the common law and section 21 of the IC Act, to the extent that it required insureds to notify the insurer of any material changes after entering into the insurance policy (as opposed to prior to entering into the insurance contract per the statutory disclosure obligation under section 21). Jackman J of the Federal Court held the term was not unfair, finding:

- Construction of the Notification Term: A literal interpretation of ‘anything changes’ should be rejected as producing absurdity. Instead, his Honour found the clause required notification only of changes to information previously provided by the insured to the insurer, not every minor change in the insured property or contents.

- No significant imbalance: As the clause was reasonably related to the insurer’s legitimate interest in risk assessment and management, and because provisions of the IC Act – particularly section 13 (duty of utmost good faith) and section 54 (which affects the insurer’s exercise of contractual rights to refuse to pay a claim) – were to be implied in construing the Notification Term which limited how A&G could enforce the clause to potentially refuse claims.

- Reasonably necessary to protect legitimate interests: The Notification Term was reasonably necessary for A&G to protect its legitimate interests, including ensuring it was not insuring risks it would not have accepted had it known of the changes to the insured’s home and contents.

- Detriment: While the clause could cause detriment to consumers (e.g. through denial of claims, or cancellation of the policy), this was not sufficient to render the term unfair unless the other two criteria were also met.

Full Court decision

On 19 April 2024, ASIC appealed the Federal Court’s decision. The appeal was heard before the Full Federal Court on 28 August 2024. The Full Court addressed each of ASIC’s grounds of appeal, determining:

- the proper construction of the Notification Term;

- whether the term caused a significant imbalance in the parties’ rights and obligations; and

- whether it was reasonably necessary to protect the insurer’s legitimate interests.

In assessing grounds 2 and 3, the Full Court considered the transparency of the term, noting transparency should be assessed against each limb of the unfairness test.

While finding that the primary judge erred in the construction of the Notification Term (ground (1)), the Full Court ultimately upheld the primary judge’s decision, concluding that — when properly construed with a materiality qualification relating to the insured risk — the notification term did not cause a significant imbalance, was reasonably necessary to protect A&G’s legitimate interests, and did not lack transparency to the extent required to be considered unfair.

Key observations of the Full Court include:

- Proper Construction inferred materiality: The Full Court upheld ASIC’s construction of the term (that the obligation to notify ‘if anything changes’ is qualified by a criterion of materiality relating to the risk insured) and rejected A&G’s and the primary judge’s construction (that ‘anything’ referred to any changes to information previously provided to A&G before entering into the contract). This construction was supported in the text, context and purpose of the contractual documentation, and illustrated in the 11 examples provided in the term. The Full Court also found that the primary judge erred in finding that the task of construction did not involve considering what an ordinary consumer would have understood the Notification Term to mean. The proper approach to construction (given that the contract in question was a consumer contract) is to consider what the Notification Term would mean to a reasonable individual, as a matter of ordinary language, reading the contractual documentation as a whole.

- No significant imbalance in the parties’ rights and obligations: Based on the proper construction of the term (as above), even before considering any implied duties contained in the IC Act such as the implied duty on A&G to act in good faith (section 13) or restrictions on when insurers can refuse to pay claims (section 54) who found those.

- Reasonably necessary to protect legitimate interests and transparent: ASIC was incorrect in submitting that the Notification Term suffered from a fatal lack of transparency such that it was not reasonably necessary to protect A&G’s legitimate interests. Properly construed, the term was not ambiguous or lacking in transparency to a degree that would render it unfair, even though alternative drafting may have been clearer.

Significance

The judgment provides important guidance on how the unfair contract terms regime applies to insurance contracts post-Hayne Royal Commission reforms extending the regime to insurance contracts governed by the IC Act. It clarifies that statutory consumer protections under the IC Act, such as the duty of utmost good faith under section 13 and the operation of section 54 in restricting an insurer’s exercise of its power to refuse claims, must be considered in assessing the fairness of insurance terms, but that these do not automatically immunise provisions of an insurance contract from the unfair contract terms regime (rather they are relevant to the assessment of each limb of the unfairness test). The decision underscores the need for clear drafting in insurance contracts (and examples can help) and the careful balancing of consumer protection with insurers’ legitimate interests.