This post is part of our series on Climate Change Disputes. Our earlier posts include: Climate Change Disputes 101: An Introduction, a post on Australia, a post on China Mainland, a post on Hong Kong, and a post on Singapore.

The High Court’s recent landmark ruling that the UK’s Net Zero Strategy is unlawful has cast a renewed light on climate change litigation in the UK. With heightened concerns over global warming and increased regulatory initiative, climate litigation risk has grown. This post provides a snapshot of the types of climate related disputes in the UK and implications for businesses.

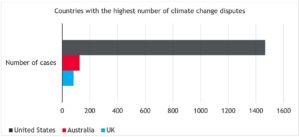

Disputes relating to climate change have increased dramatically in recent years. As of August 2022, at least 2,071 climate change related cases have been identified, and more than 1,200 cases were filed in the last seven years (following the 2015 Paris Agreement). The UK tracks as the third most active jurisdiction globally for climate change litigation, following only the United States and Australia.

(Source: https://climate-laws.org/)

In 2008, the UK passed the Climate Change Act, the first law of its kind implementing enforceable carbon reduction targets and setting the legislative framework for climate action in the UK. Since then, there have been numerous policy developments in the UK to address the effects of climate change. Most recently:

- Mandatory disclosures for large companies: Since April 2022, over 1,300 of the largest UK-registered companies and financial institutions must disclose climate related financial information on a mandatory basis, as part of the UK Government’s Green Finance Strategy.

- Broader sustainability disclosures expected: In July 2021, the UK Government announced plans to introduce new Sustainability Disclosure Requirements (SDRs) across the economy that go further by requiring companies, asset managers, asset owners, and creators of investment products to report on how their activities contribute to climate change.

Want to jump directly to our tips? Click here.

Greenwashing and misleading environmental claims

Greenwashing is a term used to describe the providing of false or misleading information about a company’s “green” credentials. In the UK, greenwashing may lead to claims (for example, in misrepresentation), and regulatory action under existing consumer and financial services law.

Following its review, the UK’s Competition and Markets Authority (CMA) found that greenwashing has become prevalent, and that thousands of companies may be breaching the law. This led to the publication of the Green Claims Code in September 2021 to help businesses understand and comply with their consumer law obligations when making environmental claims.

The CMA can take enforcement action of its own or refer matters to one of the bodies with which it shares its consumer protection enforcement powers, such as the UK’s Advertising Standards Authority (“ASA”). The ASA published a statement on the regulation of environmental claims and issues in advertising in September 2021, and has taken enforcement action to clampdown on greenwashing.

For example, in February 2020, the ASA found that Ryanair’s statements “low CO2 emission” and “lowest emissions airline” were misleading because doubts arose concerning Ryanair’s data and Ryanair did not prove that compared to other airlines its carbon emissions were lower. In July 2020, the ASA found that Shell’s advertisement “drive carbon-neutral” was misleading as consumers could have the mistaken belief that Shell Go+ is a new carbon-neutral fuel rather than a carbon offsetting loyalty scheme.

The UN recently established an expert group to tackle confusion over emissions cuts and net zero targets, intending to set a road map for international and national regulations. For more, see our KWM insight here.

Shareholder activism and claims against companies and company directors

Cases against corporations and directors for climate change damage or inaction have risen globally. So far, no English case has found directors in breach of their directors’ duties due to their failure to address climate change. However, the litigation risk in this area is increasing.

In McGaughey & Davies v Universities Superannuation Scheme [2022] EWHC 1233 (Ch), the members of a pension scheme filed a derivative action against the pension’s directors, alleging that by investing in fossil fuels, they breached their directors’ duties under the Companies Act 2006 and failed to act in the beneficiaries’ best interests. The Court did not allow the derivative action to continue as the claimants did not satisfy the requirements for pursuing a derivative action.

In a recent development, ClientEarth, a shareholder of Shell, announced that it intends to commence a derivative claim in the English courts against Shell’s directors for allegedly failing to adopt a climate strategy that aligns with the Paris Agreement. ClientEarth claims this breached Shell’s directors’ duties under s. 172 (duty to promote the success of the company) and s. 174 (duty to exercise reasonable care, skill and diligence) of the Companies Act 2006. This could become the first English authority on whether directors can be compelled to act or held liable for their action or inaction on climate change.

It remains to be seen if the English courts are willing to go as far as the Hague Court in its landmark ruling in Mileudefensie et al v Royal Dutch Shell Plc. In that case, the Dutch court ordered Shell to reduce the company’s global net carbon emissions by 45% (compared to the 2019 levels) by 2030, on the basis of a corporate duty of care and due diligence obligations.

Claims against the Government for inadequate climate action and policies

There has been a rise of climate change litigation globally relating to the failure of governments to take adequate climate action. In the UK, these challenges are typically brought by individuals or NGOs as judicial review claims. Until recently, the English courts rejected these claims in most instances. For example:

- In Elliott-Smith v Secretary of State for Business, Energy and Industrial Strategy & Ors [2021] EWHC 1633 (Admin), the High Court rejected the judicial review claim, concluding that the UK Emissions Trading Scheme was lawful.

- In R (oao Plan B Earth & Ors) v the Prime Minister & Ors [2021] EWHC 3469 (Admin), the High Court rejected a claim that the UK Government had failed to take practical and effective measures to meet the UK’s climate change commitments under the Paris Agreement and Climate Change Act.

- In R (oao Cox & Ors) v The Oil and Gas Authority & Secretary of State for Business, Energy and Industrial Strategy [2022] EWHC 75 (Admin), the High Court rejected a claim that the UK’s Oil and Gas Strategy was unlawful in light of the Net Zero Strategy.

However, in the recent landmark decision of July 2022, mentioned at the top of this post, the High Court held that the UK government’s Net Zero Strategy was unlawful and breached the Climate Change Act. In R (oao Friends of the Earth) v Secretary of State for Business, Energy and Industrial Strategy [2022] EWHC 1841 (Admin), Friends of the Earth, ClientEarth, and Good Law challenged the Secretary of State’s Net Zero Strategy, arguing that it was vague, flawed, and unlawful because it did not specify what impacts it would have on greenhouse gas emission reduction. In its groundbreaking judgment, the Court held that the Net Zero Strategy is unlawful because it does not sufficiently set out detailed proposals and policies to meet the 2050 net zero target.

The Court ordered the Government to lay before Parliament a report which complies with the Climate Change Act by no later than 31 March 2023. The Government has said it is considering whether to appeal the ruling.

Challenges to projects and decisions of public bodies

The UK has also seen claims seeking to challenge administrative and government decisions with respect to planning permission, permits, and project approvals. These cases typically concern whether a decision is compatible with climate change commitments and whether the climate change impacts have been sufficiently assessed.

In a judicial review claim seeking to block the Heathrow Airport expansion, the Court of Appeal held that the Government’s Airports National Policy Statement (“ANPS”) was unlawful because it failed to consider commitments under the Paris Agreement: Plan B Earth v Secretary of State for Transport [2020] EWCA Civ 214. On appeal by Heathrow Airport, the Supreme Court overturned the decision and found the ANPS to be lawful: R (On the Application Of Plan B Earth & Friends of the Earth) v Heathrow Airport Ltd [2020] UKSC 52. The Supreme Court found that the developers would still be required to address climate change effects at the stage of applying for planning permission.

In R (oao Finch) v. Surrey County Council [2022] EWCA 187, the claimant applied for judicial review, arguing that a local council’s failure to assess scope 3 emissions in an environmental impact assessment (“EIA”) breached the EIA Regulations and was contrary to the Net Zero Strategy. In a 2:1 split decision, the Court of Appeal concluded that the lack of assessment of the scope 3 emissions did not make the decision to grant the permit unlawful (at [65]-[66], [94], [141]-[150]). However, the dissenting judge would have held that the council acted unlawfully in granting the permit (at [95], [140]).

In R (oao Friends of the Earth) v Secretary of State for International Trade Export Credits Guarantee Department (UK Export Finance) [2022] EWHC 568, the claimants challenged the legality of the Secretary of State’s decision to fund an LNG project in Mozambique, alleging that the decision was unlawful because it was reached without regard to essential climate change considerations. In a split judgment, one judge found that the decision did not breach the Paris Agreement objectives (at [236]-[243]), while the other concluded that it was unlawful as the failure to quantify scope 3 emissions and other flaws meant there was no rational basis on which to demonstrate that the funding for the project was consistent with the Paris Agreement (at [244], [330]-[337]). Permission to appeal has been granted.

What are the key implications?

Businesses, government policymakers, and government decision-makers should prepare for the energy transition and anticipate the risks of climate change litigation.

Companies and their directors should:

- Not overstate their green credentials. They should review their climate related statements to avoid claims and enforcement action over greenwashing.

- Be prepared for increased shareholder activism and innovative litigation that seeks to compel companies to implement climate friendly policies that align with the Climate Change Act and Paris Agreement goals.

- Be aware of judicial review being used in the UK to change government policy and strategy, and to challenge decisions of public bodies on public and private sector projects.

- Keep up to date with ongoing reforms and ensure they are ready to comply with increased transparency and disclosure requirements.

Want to know more about greenwashing and climate change litigation in other jurisdictions? See our other blog posts on KWM Pulse and insights at KWM:

- ‘Fake movers’, ‘greenwashing’ on United Nations radar: How to respond

- Is your green claim true blue? Environmental sustainability named as one of the ACCC’s key priorities for FY22/23

- Climate change litigation – what is it and what to expect?

- IPCC report fans litigation risk flames

- Greenwashing hits court room