The EU’s landmark decarbonising measure, CBAM, has begun to phase in.

CBAM (the Carbon Border Adjustment Mechanism in full) puts a price on greenhouse gas emissions generated in the production of goods imported into the EU. The EU’s climate ambitions aren’t always matched by other jurisdictions – CBAM is the EU’s way of addressing this disparity and avoiding carbon leakage (more on that below).

Importers do not have to pay under CBAM yet, but should prepare to be bammed! by CBAM from 2026. Plus, quarterly reporting starts now – and penalties apply for failing to submit reports.

The European Commission released guidance documents in November to help non-EU operators and those importing to the EU. Please reach out to us if you’d like help understanding, adapting and complying. We are watching developments as they happen.

Now – onto 10 things to know as you prepare!

1. What is carbon leakage?

The EU is targeting climate neutrality by 2050.

CBAM aims to address carbon leakage and reduce the global carbon footprint by incentivising less carbon-intensive industrial production practices outside the EU.

Carbon leakage is not (in this instance) about leaking carbon emissions. It occurs under CBAM when:

- EU-based companies move carbon-intensive production outside the EU, typically to developing countries with less stringent climate regulations/ policies, or

- EU products get replaced by more carbon-intensive imports with lower or no carbon costs.

2. Why is CBAM important?

When an EU product is the subject of a carbon cost, its price inevitably increases. The EU product may be more expensive than equivalent imported goods which are not subject to the same carbon cost, and that’s when carbon leakage occurs.

CBAM tries to inject fairness into this equation, and ensure the problem isn’t simply shifted elsewhere (and to the advantage of another business). CBAM applies a carbon cost to imported goods for the greenhouse gas emissions generated from their production, as if they were produced in the EU. It equalises the carbon cost of carbon-intensive imports with that of their EU equivalents, and disincentivises importers from moving carbon-intensive production abroad to countries with no or lower carbon costs.

Interestingly, outside of the EU, Australia is also considering introducing a similar carbon border adjustment mechanism.

Think about it this way. If you are a business, do you want to minimise your costs? If you are a consumer, do you want to pay more for the same product? CBAM is working against these natural instincts.

3. Six initial sectors

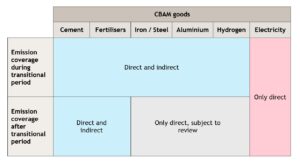

CBAM initially applies to six targeted sectors, selected based on high risk of carbon leakage and emission intensity: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen.

CBAM covers both direct emissions (generated by the production processes) and indirect emissions (from the electricity consumption during the production processes) – the calculation of the emissions depends on the nature of the goods.

The goal is to extend the scope to the goods of all sectors covered by the EU Emissions Trading System (EU ETS) by 2030.

4. Where is CBAM at now? No need to pay… yet!

CBAM will be implemented in 2 phases:

- Transitional from 1 October 2023 to the end of 2025 – reporting only

- Full implementation from 1 January 2026 – must purchase CBAM certificates (ie payment time)

On 1 October 2023, CBAM entered its transitional phase, with the first reporting period for importers ending 31 January 2024.

Prior to 31 December 2025, importers will only need to submit quarterly reports outlining the greenhouse gas emissions for their imports. The transitional phase is a ‘reporting phase’. Importers do not have to make any financial adjustments or purchase CBAM certificates until the full implementation of CBAM in 2026.

5. Don’t forget your CBAM certificates

CBAM certificates are electronic certificates corresponding to the emissions for imported goods, and must be submitted under CBAM. CBAM certificates will be sold to authorised CBAM declarants in EU member states on a common central platform.

Once the full phase kicks in on 1 January 2026, EU importers of goods covered by CBAM must purchase and surrender CBAM certificates corresponding to the amount of greenhouse gas emissions for their imported goods.

Each year, EU importers must declare by 31 May the quantity of goods and the greenhouse gas emissions for those goods imported into the EU in the preceding year.

6. How much do I need to pay for CBAM certificates?

The price of CBAM certificates will depend on the weekly average closing prices of EU ETS allowances, expressed in € / tonne of CO2 emitted. The EU ETS is market-based and determined by the supply and demand for allowances. In other words, the price of CBAM certificates will be linked to the EU market price of carbon.

7. What if I’ve already paid a carbon price in third countries (non-EU countries)?

Don’t worry, you won’t be charged twice. If a non-EU producer can show that a carbon price for the greenhouse gas emissions was paid in the country of origin, the corresponding amount can be deducted (ie the number of CBAM certificates required to be surrendered will reduce).

8. Penalties will apply – beware

The EU will impose monetary penalties for non-compliance, including:

- when an authorised CBAM declarant fails to surrender corresponding CBAM certificates, and

- when a person who is not an authorised CBAM declarant imports CBAM goods into the EU.

9. How will CBAM affect me in Asia?

Your EU customers are going to ask you to start supplying them with details of the direct greenhouse gas emissions generated by the production process for your goods, as well as the indirect emissions associated with the electricity used to produce them. Time to start preparing now!

From 2026 your EU customers are going to have to pay a carbon tax in the EU on your goods, to the extent you have not already paid the same amount of carbon tax on your goods in their place of origin.

Put simply, your goods are going to become more expensive for your EU customers. Your EU customers may seek to pass a portion, if not all, of that cost increase onto you as the supplier (ie by reducing what they are prepared to pay for your goods).

Fewer emissions in producing your goods means less carbon tax payable by your customers and less pressure on you to absorb it. It is time to start decarbonising your production processes now!

10. Practical recommendations – start now! How to prepare?

The clock is ticking! It is time to start…

- determining the direct and indirect greenhouse gas emissions for your in-scope goods produced outside of the EU. Once you have worked that out, you can start to think about how much CBAM is going to cost you.

- looking at reporting options – there is some flexibility until 2024-end. You can choose one of three methods of reporting – either in full using the EU method that will apply under CBAM, using an equivalent method, or (until July 2024) based on default reference values. You’ll have to choose the EU method from January 2025. Now is the time to start the practice of recording and reporting.

Want to know more about your CBAM obligations and other matters on ESG? Get in touch! We are passionate about ESG and keen to discuss and generate new ideas with you.

Related insights: