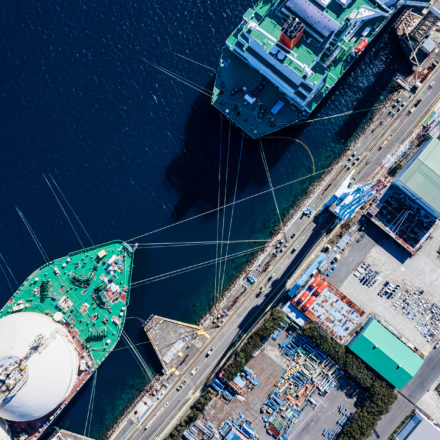

Scott Gardiner and Tiffany Kwong recap the groundbreaking new rules in the EU that require large companies to undertake due diligence on their value chains. The CSDDD is now in force and staggered implementation will begin. Could it set a global standard?

World-leading new rules in Europe that introduce compulsory due diligence duties for large companies (how large? Read on!) entered into force on July 25, 2024. The duties are groundbreaking for imposing mandatory obligations on in-scope companies to act on sustainability – not just a company’s own. The due diligence requirements extend to subsidiaries and the chain of activities up and downstream – no more hiding behind a company’s walls!

Companies should shape up now and examine their business thoroughly, as violations could lead to civil liabilities on the parent company.

At its heart are requirements to not only identify, but importantly to prevent, mitigate and account for actual and potential adverse impacts, across environmental and human rights measures. In-scope companies must also adopt a transition plan for climate change mitigation.

The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) was published in the Official Journal of the European Union on 5 July 2024, entering into force 20 days later. EU member states have two years to transpose the CSDDD into their national laws, that is, by 26 July 2026.

The Directive will steer businesses towards responsible behaviour and could become a new global standard with regard to mandatory environmental and human rights due diligence. – European Commission

You can read our previous insight on preparing for the new regime here.

By way of recap (with dates of application, now that it is published)…

Which companies are in-scope?

EU companies with >1000 employees and >EUR 450 million net worldwide turnover

Non-EU companies with >EUR450 million net turnover in the EU

EU company/ultimate parent company entering into franchising/licensing agreements in the EU, with total royalties of >EUR22.5 million AND the company/ultimate parent company with worldwide net turnover of >EUR80 million

Non-EU company/ultimate parent company entering into franchising/ licensing agreements in the EU, with total royalties of >EUR22.5 million in the EU AND the company/ultimate parent company with net turnover of >EUR80 million in the EU

When will companies need to comply with the CSDDD?

The CSDDD will first apply to larger in-scope companies.

26 July 2027

EU companies with >5,000 employees and net worldwide turnover of >EUR1.5 billion

Non-EU companies with net turnover of >EUR1.5 billion in the EU

26 July 2028

EU companies with >3,000 employees and net worldwide turnover of >EUR900 million

Non-EU Companies with net turnover of >EUR900 million in the EU

26 July 2029

All other in-scope companies (including in-scope franchisors and licensors)

What is required?

The CSDDD establishes a framework for a ‘responsible and sustainable approach to global value chains’. This covers human rights and the environment (including, respectively, those in line with various human rights and fundamental freedoms instruments and environmental instruments).

The CSDDD requires not only looking at a company’s own potential and actual adverse impacts, but those of subsidiaries and business partners related to their chain of activities.

Companies will have to meet a series of obligations ranging from integrating due diligence steps into policies, to identifying potential and actual adverse impacts, and preventing and bringing any to an end. This includes a heavy ‘last resort’ that could see the termination of a business relationship if steps fail to prevent or mitigate an adverse impact (whether actual or potential). It’s worth sharing the diagram from our earlier insight here.

Did you know…

We couldn’t complete this recap without a fun fact.

Due diligence is a concept widely understood and applied in the corporate world. Commonly, it’s the effort a company takes to research ahead of a transaction – whether it’s extending finance, making a sale or acquisition, or entering a business venture.

Yet, it has a longer history than modern corporate use. The Merriam-Webster dictionary explains:

Due diligence has been used since at least the mid-fifteenth century in the literal sense “requisite effort”.

The legal use around taking reasonable care to avoid harm to people or property (snail in a ginger beer bottle, anyone?) emerged centuries later.

What’s next – will the CSDDD create a global standard?

This regulation is the first of its kind, and it’s important to consider how it covers non-EU companies meeting the relevant thresholds.

The EU Commission is also required to submit a report on the necessity of additional tailored requirements for financial institutions after 25 July 2024, but no later than 26 July 2026.

Additionally, it is critical to recall that the Corporate Sustainability Reporting Directive (CSRD) – Europe’s sustainability reporting obligation – was also pioneering when it was adopted in 2022, the most comprehensive reporting framework globally. Jurisdictions around the world are now introducing sustainability disclosure standards, including Australia (look out for our global snapshot to come).

It’s a space to watch.

Want to know more? Have a look at related insights: