Dale Rayner, Selena Liu and Nick Forbutt share key takeaways from the landmark report on Australia’s carbon market, released by the Carbon Market Institute.

The way businesses use carbon credits is undergoing dramatic change. At the same time, Australia’s carbon market is scaling up.

The Carbon Market Institute (CMI) launched its inaugural Carbon Market Report in April 2024, sponsored by Westpac, with the aim of keeping market participants informed in a rapidly changing environment as we move towards net zero carbon emissions.

The 2024 CMI-Westpac Carbon Market Report (Report) – titled ‘Carbon Markets and Australia’s Net Zero Challenge’ – examines the state of the Australian carbon market and its role in contributing to the fight against climate change and biodiversity loss.

In this insight, we share key takeaways from the Report. This includes the significance of implementing market-based reforms to ensure that:

- the Australian carbon market can scale-up

- Australia’s nature repair markets complement the carbon market, and

- carbon credits maintain high-integrity and credibility.

A well-functioning domestic carbon market is an essential tool to meet emissions reduction targets and net zero challenges for both Australia and its corporates. For more insights, visit our Carbon page and subscribe to updates.

The Australian carbon market is scaling up – here’s how

While Australia’s carbon market has experienced its fair share of modifications since it was established more than a decade ago by the Clean Energy Act 2011 and the Carbon Farming Initiative Act 2011, the Australian carbon market is currently characterised by:

- the Australian Carbon Credit Unit Scheme (ACCU Scheme) (voluntary): this incentivises carbon abatement by allowing project proponents to register emission reduction projects under various methodologies and generate ACCUs for avoiding emissions or sequestering carbon, and

- the reformed Safeguard Mechanism compliance scheme (mandatory): this applies to industrial facilities that emit more than 100,000 tCO2-e of direct emissions in a financial year (Safeguard entities).

Australia is projected to become one of the world’s top carbon credit producers in the next decade. The Report identifies several developments related to these schemes that are expected to scale-up carbon markets and accelerate the speed of the energy transition.

- Safeguard Mechanism driving ACCU demand. ACCU demand is forecasted to peak at 31 million units in 2031. As the reformed Safeguard Mechanism completes its first year, the Report anticipates strong buying of ACCU’s from Safeguard entities as they prepare for the February 2025 compliance deadline for the surrender of ACCUs to meet their newly set emission baselines, which decline by 4.9% annually to 2030 and to zero by 2050. The rising demand from Safeguard entities is expected to outpace voluntary buying and become the main driver of ACCU prices. (Report, pages 16, 20, 24)

- ACCU Scheme reforms. The Independent Review of ACCUs (Chubb Review) was commissioned by the federal government in 2022 to ensure Australia’s carbon crediting framework was fit for purpose and high integrity. Following the Chubb Review, the Report identifies two significant reforms to the ACCU Scheme:

(i) The first EOI process for the proponent-led method development under the ACCU Scheme (expected later in 2024) is anticipated to lead to more sophisticated methodologies for earning ACCUs and a more diverse range of carbon projects that incorporate new technologies for carbon abatement. This innovation is important as the Report identifies that Australia may need up to eight times the current level of land-based sequestration by 2050. (Report, pages 16, 30)

(ii) There is a now greater information available about projects in the updated Australian National Registry of Emissions Units, which should assist buyers of ACCUs in assessing the alignment of a particular methodology, project, or proponent with their objectives. (Report, page 13)

- Building market infrastructure. To ensure the Australian carbon market can scale-up, policymakers and market participants are working on building the necessary infrastructure and governance to efficiently manage risk and allocate capital. For example, the Report notes that:

(i) The Clean Energy Regulator is upgrading technology infrastructures to help carbon markets scale, including by developing a new Unit & Certificate Register which will incorporate new units and certificates as they are developed and be interoperable with the proposed Australian Carbon Exchange. (Report, page 49)

(ii) The ASX is planning to launch a suite of Environmental Futures Contracts to serve the markets for ACCUS, renewable energy certificates and New Zealand carbon units. A standardised ACCU Futures market hosted by ASX is expected to help scale-up carbon and renewable trading markets. (Report, page 43)

- Changing corporate behaviour. The ACCU Scheme continues to support organisations that are taking voluntary action to reduce their net emissions. However, the Report observes a shift in how companies use and choose carbon credits as the market moves from focusing on carbon neutrality to aligning with net-zero goals to beyond their value chains. This trend reflects community expectations, with a recent survey conducted for the CMI showing that 77% of Australians expect businesses to take responsibility for all their emissions now or become carbon negative. (Report, pages 8-9)

The Nature Repair Market is a game changer that will complement carbon markets

Australia’s legislated Nature Repair Market, which allows the trading of biodiversity certificates issued for nature restoration projects, is expected to become operational later in 2024. This market is intended to complement the Australian carbon market, with a view to proponents being able to carry out projects that meet the requirements and reap the benefits of both markets.

The Australian Climate and Biodiversity Foundation’s (ACBF), chaired by former head of Treasury Ken Henry, proposes in the Report that carbon markets and their participants can assist the development of nature markets through three key innovations:

- Prioritising the development of carbon methods and projects that protect and restore ecosystems with high value environmental co-benefits. For example, by using an ACCU scheme levy to create a biodiversity top-up fund to incentivise many more habitat-focused ACCU projects (such as environmental plantings, forest protection and improved avoided regrowth clearing methods). (Report, page 39)

- Creating the infrastructure for well-functioning nature repair markets that complement carbon markets. This includes strict standards and verification, science-based measurement methods backed by environmental accounting, robust verification and transparency guarantees. This work is currently taking place through the method development under the Nature Repair Act 2023, environmental accounting, as well as the continued development of trading platforms. (Report, page 40)

- A new Australian Government public fund to kick-start nature markets to invest in nature repair certificates. The ACBF argues that this would provide a demand-side driver to stimulate initial market development and encourage innovation in nature repair by land managers and project developers, citing the government kickstart funding for the former Emissions Reduction Fund which supported the growth of the ACCU Scheme. (Report, page 40)

Integrity in carbon markets has to improve (and will)

While Australia’s domestic carbon market is generally considered to be a high-integrity market, the market is evolving to address criticisms from stakeholders and improve integrity.

The Report (page 55) notes that the world is gradually moving toward mandatory disclosure on carbon credit use, with the EU and California mandating the disclosure of detailed information about the use of credits. Mandatory sustainability reporting is imminent in Australia following the introduction of the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 to the House of Representatives, which will require companies to have a robust due diligence and verification processes to support their use of carbon credits.

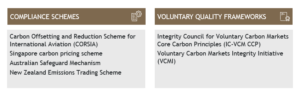

At the same time, a range of carbon market integrity frameworks and standards have recently been developed to standardise best practice in carbon credit use and disclosure (page 59). The below table prepared by Tasman Environmental Markets outlines the complex interplay of integrity benchmarks with various schemes.

The Carbon Market Integrity web: Summary of interacting schemes, benchmarks, and frameworks

Source: Report, page 64

We are watching developments. Subscribe to stay updated!

- Want to keep track of compliance deadlines across Australia, Chinese Mainland and Hong Kong? Check out our carbon markets regulatory trackers.

- From the latest updates on ACCUs, to China’s landmark carbon markets and the global landscape – read our latest Carbon insights.