“Having a common understanding of what is sustainable is essential if ASEAN is going to attract and orient capital towards sustainable investments and away from non-sustainable activities. This is where a credible regional sustainable finance taxonomy, which is interoperable with other regional and international taxonomies, is needed.” – ASEAN Taxonomy Board

The Association of Southeast Asian Nations (ASEAN) Taxonomy Board has released the second version of its Taxonomy for Sustainable Finance (ASEAN Taxonomy), in a landmark bid to enable a just transition.

The 209-page ASEAN Taxonomy harmonises the approach to classifying sustainable activities and assets, providing a ‘common language’ for assessing whether a company and its activities are sustainable. It follows public consultations held in 2022 and seizes a trend that is seeing national taxonomies ripple across the region.

The intention is for it to be interoperable with international standards on green investment – including the EU Taxonomy – as well as those of ASEAN member states. And member states are moving.

Singapore recently launched the third round of public consultations on its ‘traffic light classification system’. On February 15, stakeholders were asked to provide input on the classification of activities in the agricultural, industrial, water and waste, technology, and carbon capture and sequestration sectors. Indonesia introduced its green taxonomy in January 2022 similarly adopting a traffic light approach, and Malaysia introduced its principles-based approach in April 2021. More developments in classifying sustainable finance activities are on the way: Malaysia is consulting on a more detailed national taxonomy, and The Philippines, Thailand and Vietnam are also in the process of designing taxonomies.

The increasing appetite for clear and consistent classifications for transition finance in Southeast Asia follows the introduction of taxonomies in the European Union (EU) and China (along with a Common Ground Taxonomy between the two).

In this post, we look at the state of transition finance taxonomies – essentially, classification systems – across Southeast Asia, with a focus on the timely release on March 28 of the ASEAN Taxonomy (Version 2).

The importance of a transition finance taxonomy to Southeast Asia

It is hard to understate the importance of the ASEAN Taxonomy, as the region looks to attract and mobilise finance to help facilitate projects that both increase climate resilience and mitigate climate change.

Southeast Asia is uniquely susceptible to the impacts of climate change because of its coastal populations and the economy’s heavy reliance on agriculture. Extreme weather, rising temperatures and sea levels, and damage to ecosystems have injured the economy and threatened the livelihood of the millions of people who call these nations home.

Without a suitable taxonomy in place, investors have no reliable way of measuring the sustainability of their investments within the region, which in turn means that ASEAN Member States may lose out on sustainable finance funds.

The ASEAN Taxonomy Board was established in March 2021 to address this problem by developing a science-based and inclusive taxonomy, releasing the first version later that year. The second version expands on the first, equipping member states with use cases, decision trees, and more detailed guidance. Critically, it includes a consideration of social aspects, expanding the environmental impact focus of the first version.

The ASEAN Taxonomy defines what it means for an activity or project to be sustainable. In turn, this provides investors greater certainty and transparency on what their funds will be used for and gives clear guidance to businesses on what they need to do to attract sustainable finance and reach their sustainability goals. Investor certainty is critical for scaling sustainable and transition finance markets, as is uniformity in standards applied across jurisdictions.

The ASEAN Taxonomy caters to the diversity of ASEAN member states by giving two options for assessment: a starter, principles-based ‘Foundation Framework’ and a more advanced, technical ‘Plus Standard’

Both the Foundation Framework and the Plus Standard assess projects or activities in terms of their sustainability using a ‘traffic light’ system. Projects are given a green, amber or red status.

How it works

For classification under either the Foundation Framework or the Plus Standard, a company must show:

- It contributes to at least one Environmental Objective (without adversely affecting the others)

- It fulfils all three of the Essential Criteria

The Foundation Framework then classifies activities on a qualitative basis using a decision tree as distinct from the Plus Standard which uses quantitative measures. The Plus Standard applies a Technical Screening Criteria and thresholds that are clearly defined, based on science and periodically revised.

How the Foundation Framework seeks to ensure fair and wide-spread access

A taxonomy solely based on metrics and thresholds would likely exclude a large portion of the ASEAN community and hinder their ability to attract sustainable finance funds. ASEAN Member States are at differing levels of development with varying economic and social structures, and small to medium enterprises are the backbone of the region’s economy. This means that some States and some enterprises may lack the requisite resources to quantitatively describe the sustainability level of their activities. A qualitative measure, which is not dependent on rigorous data collection, widens access by enabling businesses and investors from all ASEAN Member States to assess the sustainability of various activities across all sectors.

The Foundation Framework gives examples of decision trees to follow in undertaking an assessment, asking a series of questions leading with climate change mitigation (as the primary objective) to determine the status of the activity. That includes questions on social aspects – an addition from the first version. By contrast with the EU Taxonomy, governance safeguards are not (yet) part of the framework.

Guiding questions help members through the decision tree when assessing companies. Examples include:

- “Does the Activity avoid significant GHG emissions, incl. CO2, CH4, N2O, SF6, NF3 and/or HFCs?”

- “Does the Activity avoid impeding upstream and/or downstream stakeholders from increasing their resilience to climate change?”

- “Are there concrete plans established for remedial measures to address the residual harm within a defined timeframe (i.e., within 5 years)?”

- “Does the Company have policies or guidelines that uphold an individual’s right to enjoy just, decent and favourable working conditions?”

- “Does the Company employ occupational health and safety practices?”

One example of a qualitative assessment using the Foundation Framework is shown below.

Source: ASEAN Taxonomy Version 2

How the Plus Standard adds scientific criteria

The Plus Standard similarly adopts a traffic light categorisation but uses quantitative measures in addition to qualitative to classify activities. Members who opt for the Plus Standard must set Technical Screening Criteria and thresholds that are clearly defined, based on science and periodically revised. The energy, and carbon capture utilisation and storage sectors are singled out and given criteria to meet each of the traffic light ‘tiers’.

The Plus Standard six focus sectors and three enabling sectors are:

Source: ASEAN Taxonomy Version 2

What next?

The ASEAN Taxonomy is a ‘map’ intended for immediate use by member states, to guide them on their sustainable finance journey. Future versions will develop criteria for the assessment of activities across all focus sectors.

Potential users include governments, regulators, financial institutions, investors, asset managers, companies and rating agencies. Those within Southeast Asia should familiarise themselves with the ASEAN Taxonomy; for others, it’s an informative and helpful guide – particularly considering the intended interoperability.

In particular the Foundation Framework’s qualitative design provides a useful example of how a taxonomy can still be used to identify sustainable investment, even where qualitative data is missing. Given the enormous need for investment to fund the transition to net zero, it is important that investment is not delayed or directed away from key areas due to a lack of data.

What is happening at a national level across Southeast Asia?

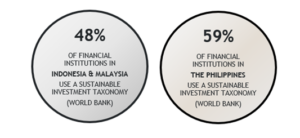

At an individual country level, the year promises significant leaps in local taxonomies. At least six Southeast Asian nations have developed or are developing their taxonomies. A recently released World Bank report called for ‘further development’ in taxonomies, noting that ‘all five [ASEAN-5] countries have benefited from the ASEAN sustainable finance taxonomy introduced in 2021’.

- Indonesia

- Indonesian Green Taxonomy edition 1.0 (IGT) (2022): voluntary ‘traffic light’ categorisation similar to ASEAN taxonomy. The IGT’s four focus sectors are based on Indonesia’s Nationally Determined Contributions under the Paris Agreement. In its development the IGT has closely considered pre-existing international taxonomies including of the ASEAN taxonomy. Initial focus has been on mitigation and adaptation efforts.

- Malaysia

- Climate Change and Principle based Taxonomy (CCPT) (2021): lacks detail and thresholds but classifies on a principles-based approach. The CCPT has given close consideration of Malaysia’s state of economic development and businesses’ climate risk management capacity. Although primarily focused on climate change, biodiversity considerations are currently being integrated within the taxonomy.

- Sustainable and Responsible Investment (SRI) Taxonomy (2022): designed to aid market participants identify which economic activities are aligned with environmental, social, and sustainability objectives. Strong focus on fundraising and investing.

- The Philippines

- Sustainable Finance Roadmap: plans to develop a national taxonomy in line with the ASEAN Taxonomy.

- Guidelines for Green, Social, and Sustainable Bond Issuance (based on ASEAN Bond Standard).

- Thailand

- Developing a taxonomy for sustainable finance that uses a ‘traffic light’ system similar to that of the ASEAN Taxonomy.

- Green, social, sustainability bonds and sustainability-linked bonds: currently compliant with ASEAN and international standards.

- Sustainable Financing Framework (2020): government loans or funding for eligible green projects (six categories) and social projects (seven categories), to support its sustainable commitments.

- Vietnam

- Developing a national taxonomy: expected alignment with the EU Taxonomy.

- Green Growth Strategy 2021-2030: updated standards on specific economic sectors and products labelled green or eco.

- Legal framework for green finance (2022): covering green bonds, green banking and green public spending.

- Singapore

- Green Finance Industry Taskforce (GFIT) Taxonomy (under consultation): uses a ‘traffic lights’ classification system and covers a broad range of sectors. The GFIT Taxonomy also includes more granular activity-level criteria and thresholds for focus sectors (including energy and transportation).

We are closely watching the transition finance landscape, across Southeast Asia and globally.